Tuesday, March 31, 2009

Onex cuts stake in Cineplex

Despite their success, I'd take the article's comment about Cineplex being "recession proof" with a grain of salt. A consumer good that has traditionally demonstrated a relatively high degree of income elasticity and even some challenging market shrinking problems in better times. I'd even go so far as to say that it's simply that they have been lucky that there have been good films put out lately. Or maybe cinema experiences simply crossed the line into becoming an "inferior good" (economic sense, not quality).

However, this speaks directly to the point I had posted previously about Private Equity winners and losers: it's a 50% sale across the board and now is a terrific time to buy something if you have the money, as Onex clearly does (or will after the sale).

It will be interesting to see what captures their interest and how they decide to invest their capital.

Bad Time to be a CEO - Air Canada Surprise Move

I think a more honest question is what do you expect these new CEO's to do? Particularly in Air Canada's case, how will having Calin replace Montie really benefit the company? What will Calin do that Montie can't? Is there a strategy behind their shake up?

In my blog post about "Why Can't Canadian's Compete", I was actually thinking about Air Canada (even though I didn't explicitly write about it), but you can tell from the broad assumptions I made that these are the same types of challenges that plague Air Canada.

Air Canada struggled in the best of times with smaller companies like West Jet offering cheap domestic alternatives and eating up their market share. It seems like in the worst of times, even with low fuel costs Air Canada can't seem to catch a break. Despite all the points made for the case of a national airline, they seem to be laid to rest by the realities that prevent a self-sustaining profitability in this industry for Canadians (remember Canadian Airlines a few years ago? RIP and acquired by AC in 2001).

This raises an interesting question for consumers: Should you cash out your Aeroplan miles (frequent flyer program for Air Canada) now? Or would it be considered risky in case they go out of business and you are stranded (What happened to Zoom customers in late August of last year - and what I narrowly happened to avoid myself on a trip to Europe by only a few weeks).

Or would you even consider paying for a ticket of a potentially distressed airline? In a similar vein to comments about GM and other distressed companies, would you buy a car if you knew the automaker might not be there to honour the warranty? Have these companies past the tipping point of no return regarding consumer confidence?

This type of behaviour and thinking certainly won't help Air Canada (nor GM), but it must be a question all their customers are asking themselves.

Monday, March 30, 2009

GM Plans Insufficient - Big Surprise?

As far as timing for strategic change management goes, this is way too late in the game. So much needs to be fixed that it was ridiculous for anyone to think that a reasonable plan could be created by the end of March as was originally hoped for.

What I do find strange is that the government is asking GM to cut it's size so dramatically. A staple of government when it comes to politics is usually to save as many jobs as possible, however Wagoner's previous plan (proposed late last year) which "included the selloff of its Saturn, Hummer and Saab brands and the elimination of about 20,000 of the company's 90,000 jobs in the United States by 2012" hardly seems like it would be popular politics, but it's the government that is requesting more drastic action.

Perhaps these dramatic times are forcing politicians to take more hardlines also. I had previously critisized government "investment" in GM, but perhaps the politicians in Washington are trying to keep the angry tax payers at bay with all the recent attention on government deficit spending.

Saturday, March 28, 2009

Earth Hour Post - TCO Models for Sustainability

Also, many "environmentally" friendly models are simply offsets of other more polluting or less sustainable practices.

As a corollary of my previous post on this topic, as with any strategic endeavour that wishes to succeed (not just on moral grounds but also on more pragmatic and physical terms), I believe it is necessary to take a more all encompassing total cost of ownership (TCO) approach. That is to say that non-sustainable processes cannot be "green washed" by offsetting the true environmental costs (with striking similarly to NIMBY).

Case in point, solar panels may be "green" with no emissions where they are installed, but they are tremendously inefficient for their purpose. NASA puts solar panels on it's space craft because it can provide a light weight, steady stream of power with the majority of its complexity and drawbacks offset off the actual device and doesn't need a complicated external fueling source (such as gasoline with atmosphere or batteries).

In deciding if something is environmentally friendly (through and through), a more cradle to grave to cradle approach is needed which encompasses the many definitions of sustainability. There are even some European counties leading in policy innovation in these areas (yes, this article was written in 2001, and we wouldn't *DREAM* of implementing something so bold here in North America).

Also, in awareness for Earth hour, I'm putting this post up as my last activity before I shut down all electronic devices I have for an hour between 8:30 PM and 9:30 PM.

Aside: Note, that "Earth Hour" is actually in Ontario's off peak hour (and by extension, most people's similar behaviour pattern) for energy consumption so we are actually saving the least amount of power possible in an hour. For Earth Hour to have maximum potential (and exposure), it probably would have been best to execute this hour during peak hours aka (7 to 11am or 5 to 8pm on a Winter weekday or 11am to 5 pm Summer weekday).

Zimbabwe Defeats Hyperinflation

When a country's currency is in trouble (hyper-inflation) most traditional fiscal and monetary policy remedies won't work. There are several rather extreme options to deal with the problem:

- Issuing a new currency

- Adopting foreign currency

However, that method is slow as it requires the people who hold the new currency to have faith in the government that controls it. Instead, Zimbabwe opted to switch to foreign currencies: US dollar, South African rand and Botswana pula. What's the downside of this option? No control on monetary policy (which works as both a plus and minus). This means that the government has no control over the currency (which for some people is a good thing in this case).

Loss of a currency is a serious issue. For instance, I would be interested in seeing what a Zimbabwe "federal budget" would look like.

Also, on the ground level, there isn't much "change" as the article states, as shop keepers don't have enough to coins and small denominations to make change and they will issue notes or ask customers to take change in the form of candies or small trinket products. This is indicative of the hiccups in the money flow and must have a negative effect on the velocity of money (and GDP).

Although this is a major step in trying to set things right, there is plenty more work to be done.

Friday, March 27, 2009

No Money? Poor? Doesn't matter: Open a TFSA

- An RRSP contribution is taken from *pre-tax* earnings. Withdrawals (before retirement or outside of special programs such as the Home Buyers Plan) are taxed as income with a penalty.

- TFSA contributions are after-tax income, but all interest earned does not need to be reported up to a $5000 limit per annum (accumulated over the life of the account). <-- This is the key part

In the meantime, you can accumulate your contribution limits year-over-year in order to contribute in greener times. If you are making money now, it's a good tax-free savings vehicle which you can withdraw from today (unlike your RRSP) without penalty.

The suggested investment strategy is to use the TFSA to hold GICs which are traditionally taxed at high rates (making them generally unattractive). However, since this account shields you from taxes, the equivalent "before-tax" calculation translates into a much higher yield (and a better Sharpe ratio - same risk, more reward).

For full details, check out the Canadian Government TFSA website and speak to your financial advisor.

Thursday, March 26, 2009

The Rise of Risk Management

Having said that, there are some new developments happening in the world of risk management relating to modeling, policy and transparency. What will be interesting to watch is exactly what form this will take when it manifests.

There is a lot of work that needs to be done on risk management, credit ratings etc. Clearly the "old systems" won't work (people have lost a lot of faith already). Although there are some fundamental hopes for recovery (economic things like GDP and unemployment), I think there are some bigger issues before the financial markets take their next evolutionary step and before we start to see real gains.

What does that translate into? Government or private sector regulation that makes sense (and I would hope that the investing public would have learned from our collective mistakes and not accept a superficial band aid solution over the surgery that's needed). Until that happens, I don't think we'll really see a flood of money back into the market.

Wednesday, March 25, 2009

Preferred Shares - Dilution Indicators and Decisions

A quick review: preferred shares are between senior tranches (debt and bonds) and junior tranches (equity) and have similar characteristics of both. They are similar to convertible bonds with coupons: A preferred share usually comes with a regular dividend payment and can be converted into common shares later when your company takes off.

While these shares in themselves have their own unique characteristics, it is interesting to look at the fundamental mechanics of how they work (and what trading volume in them indicates to investors).

Background: If you are a company, your main sources of capital are usually to issue debt (bonds) or to seek equity (investors buying stocks). However, if you are growing, pre-IPO company, you might have trouble finding a market for your capital raising products (banks won't lend you the money you need because you've already borrowed a lot, and no one is interested in buying equity in your company - your not listed, no liquidity).

This is where a venture capitalist will come in at the mezzanine financing level. The VC firm will usually offer to provide you with additionally financing you need with the goal to bring you to an IPO ready state. They want their capital investment to be senior to equity, but they also want to get some of the potential upside if your company takes off in the IPO. They will usually create an arrangment where they hold preferred shares in your company, getting regular payments, but having the option to convert to common shares.

What can we learn about a company by watching this market?

Let's do a quick recap of fundamentals analysis:

Basic EPS is calculated as follows:

NI - Net Income

PDIV - Preferred Dividends

WANS - Weighted Average Number of Shares outstanding

Analysts will be familiar with the concept of dilution. Dilution is what happens when preferred shares (or other options) are converted into common shares. The EPS can decrease because the same net income (NI) is spread over a larger base of shares.

NCS = New Common Shares issued on conversion

*Note that because the preferred shares are converted, there is no need to reduce the numerator by the preferred dividend because it is not paid out

However, an observant analyst will note that not all conversions result in dilutions. When does this happen? If you do the math, you can see the condition for this is true iff (if and only if):

What does that mean? For a moment take taxation, speculation, liquidity and emotion out of the picture. If you hold a preferred share, you would consider it a good idea to convert your preferred share to common if:

if you received the preferred dividend

Makes sense. In this case, you'd rather take the common share to gain it's EPS rather than be paid the dividend. It's a zero-sum game (the money and earnings are finite). You'll only participate in diluting the EPS if doing so allows you a larger chunk of the NI.

But also look at the larger implications: What does that mean for the company? Chances are that it is starting to grow (it's reporting positive EPS after all)! Risk (long run variation in returns) aside, it would be logical to take the larger earnings. Is this a tipping point for the company? Is it finally worth it to move from mezzanine finance into equity investing?

Now of course when we put the assumptions back in from above which we took out to illustrate the point, we suddenly see other factors come into play:

- Dividends are taxed differently than capital gains income

- Analysis of strength of earnings - affect PE ratio for common share market price

- Sharpe ratios of risk to reward - Investor risk tolerance

- Liquidity - Even though you have more equity on paper (EPS versus dividend) how much of it can easily be converted to cash is another topic all together

Modeling? Equities Research? That's Cute: *stern voice* Put some skin in the game!

While I was keen to "get started" chipping away at the 10k h milestone, I was lacking a little direction. Most mentors indicated that this blog, my equities research and valuation modeling was a good start. Other advice? "I wish I had started reading ROB [Globe and Mail's Report on Business] everyday BEFORE starting in this business / MBA", "Continue with your CFA studies" etc.

However, I was cognizant of a major self limiting factor: Without real experience, what I'm doing is just academic practice in a vacuum. When I brought this up, a VP at an M&A firm in downtown Toronto smiled and said: "Start trading with your own money. Put some skin into the game." His quick and sharp point raises a good point. As long as you can demonstrate what you are doing works, it goes a long way in developing your analytical skills. You live and die by your own sword.

I've started the process for opening a trading account where I will start actively trading. In accordance with CSC and CFA ethical standards, if I make any comments about stocks in which I hold a position, I will include full disclosures. Granted, I won't have much money in the game (just trying to demonstrate a percentage gain) and I don't expect my advice to really move the market (but as is listed at the top of this blog, consult your financial adviser before making any investment decisions).

My strategy will be as follows:

- TSE listed stocks only (Not enough US funds to trade US stocks)

- Good liquidity (tight spreads with mid to high trading volume)

- Stocks which are undervalued (PE / Book or other valuation techniques)

- Expecting capital gains (not really focusing on dividends)

- Probably biased towards tech stocks (due to my background and the profit potential in volatility)

- Probably won't hold individual stocks for too long

- I'll have to dramatically reduce my trading when I go to Rotman in Sept and,

- Will report my profit (as a time and money weighted return) on the last trading day of August

Petro Can and Suncor - Why Can't Canadian's Compete?

However, Canadian consumer products businesses always seem to be small shadow's of their American cousins. Examples?

- Jumbo Video versus BlockBuster

- Mr. Sub versus Subway

- Petro Canada (Sunoco) versus ESSO (Exxon Mobile) - Check out my post on the Petro Canada / Sunoco merger posted yesterday

Even Tim Horton's (founded out of Hamilton by the famous hockey player of the same name) was purchased by Wendy's a while back.

Now granted, there are some obvious general assumptions which apply which make it harder for us to "compete" on a comparable level playing field:

- The US has a 10x larger population than Canada, generally more demand

- Canada is geographically much bigger which results in a compound effect and lower population density

- We typically have higher tax, but enjoy more social programs

- American's have higher marginal propensity to consume (MPC) improving their GDP multiplier and demand curves

Note as well that it's not that the American's are targeting us per-say when they make an expansion onto our soil, but rather they are embracing globalization. Generally, the companies listed above have a presence in other countries as well as Canada.

Particularly in the Petro Canada / Suncor example, it's clear who's the bigger player as they will be retaining the Suncor name and CEO.

Tuesday, March 24, 2009

Petro Canada, Suncor and OTPP - What's going on?

In my solar car days working with Sunoco, they were pretty adamant about being a Canadian company, and the Toronto Star in it's article reminded readers of Pierre Trudeau's dream of a national oil champion 34 years ago and hoped for the birth of a new champion (rather than the loss of one).

Petro Canada's management has been under a lot of heat for under performing, with particular scorn directed at their international assets which appear to have very disproportionate Sharpe ratios.

While this temporarily deals with OTPP intervening in Petro Canada's management, papers have reported that the new company will operate with the Suncor name and Petro Canada CEO Ron Brenneman will assume the role of Executive Vice Chairman (meaning Suncor is clearly taking the reins). I would expect that a merger of these titan's (creating the fifth largest energy producer in North America and the largest in Canada) would probably result in downsizing, probably even at the highest management levels and through out Canada (also mentioned in the article).

Similar to the recent RIM / Certicom / Verisign M&A deal (with RIM stirring the pot for Certicom shareholders), OTPP as a holder of Petro Can should at least be credited with stirring the pot to invoke positive interest in it's holdings. The publicity of a "corrective"action by a strong activist shareholder doesn't hurt in getting public attention.

Compounding Problems - Recursion: "the cause of and solution to all of life's problems"

It briefly states that the Safe slice is sold to investment bankers, the Okay slice sold to "other bankers" and the Risky slice sold to hedge funds. While this is mostly true, there are additional problems that creep in when you look at the Okay slice. What does that mean?

The different slices and risk models are analogous to different investment vehicles (sound familiar? It should... It's a common theme in investment and the topic of my Asset Allocation post last month). They are as follows:

- Safe - Senior Tranche (similar characteristics to Fixed Income)

- Okay - Mezzanine financing

- Risky - Junior Tranche (similar characteristics to Equity)

Very quickly you can see how this recursive solution compounds the problem while obfuscating the mechanics of the underlying equity vehicle. So even if you think you are buying one class of investment, you are really buying another.

Superstructures in Social Networks

"640K ought to be enough [memory] for anyone" ~ Bill Gates, 1981

You always have to think of the consequences of your design...

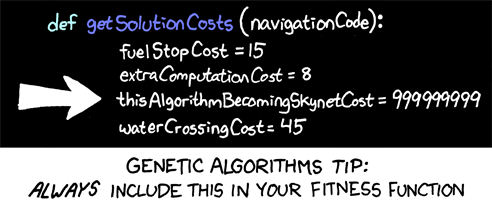

Or, as one of my favourite webcomics, xkcd, puts it:

The most recent reincarnation of the limits of software design has surfaced was Facebook's notorious 5000 friend limit. This is well above Dunbar's number (~150), a proposed theoretical natural limit to the number of useful social connections we can have.

The most recent reincarnation of the limits of software design has surfaced was Facebook's notorious 5000 friend limit. This is well above Dunbar's number (~150), a proposed theoretical natural limit to the number of useful social connections we can have.Now I'm sure a Facebook software designer would argue (rightly) that having 5000 friends is probably some form of inappropriate use of Facebook (if not outright abuse), but it turns out that is exactly what happened when popular web personalities tried to use Facebook as a tool to connect with their readership. With sky rocking success, suddenly Facebook's 5000 friend limit was a lot closer than people originally thought. Although most intentions were good (to keep closer contact with their fan bases) it turns out their success was too much for the Facebook frame work.

Certainly, most of us who imagined internet fame didn't conceive of this type of double edged sword.

I was recently speaking with a colleague who is a lead software developer for a popular Facebook application who was describing the processing inefficiencies that managers don't seem to understand when they design systems. Recopying entire databases, poor message protocols etc. Even with the most efficient code, there was that nasty problem of becoming 'popular', and suddenly experiencing exponential network growth. In a system like Facebook, where connections are always 'two-way', it exacerbates the problem.

What does that mean exactly? Unlike Twitter, where connections are generally one way (I follow you, but you don't HAVE to follow me), Facebook connections are all bidirectional - There is one connection shared between us. However, Twitter, each connection is one way and as such, you can have one popular node (such as a Barack Obama) with many connections in without as many connections out. What does this translate into?

This simple assumption dramatically cuts down on the memory, processing and bandwidth requirements needed to provide the same level of basic service. But even, if the technology will permit it, are our minds too "primitive" to keep up? Or is it just physically impossible to reply and stay current at that volume on such an intimate level (versus the traditional mass communication channel models)?

I'm quite surprised that Facebook servers don't burst into flame each time someone logs into their website. At the time of writing, my Facebook boasts exactly 450 friends. From what I can see on my friends connections, this is hardly staggering. If you asked me to design a search algorithm that identified the latest activity of 450 people and then sorted them in order of time and relevance on my homepage in real time (a few seconds loading and transmission delay), I might have a heart attack (or a very large consulting contract). However, it becomes very clear (especially with their previous incarnation of "More / Less stories about..." design) that there is an inherent (unstated) hierarchy of friends. I would almost expect it to be a sort of "page rank of friends" that helps Facebook efficiently sort interesting stories for you.

Monday, March 23, 2009

The Crisis of Credit Visualized

My personal favourite part is when they show "irresponsible" borrowers. My friend and I glanced at each other as we both new the part about "irresponsible" borrowers was coming. As it came up we burst out laughing. Follow this link for Part II.

The original website is by Jonathan Jarvis.

The Daily Show: March 12, 2009 - Stewart v.s. Cramer

I hope it was certainly was as painful for you to watch as it was for Jon "to do".

Why I love YPBlogs

Readers may have noticed that I've recently subscribed to various Blog directories in a narcissistic attempt to drive more traffic to my website, boost my page rank and generally solicit more feedback on my postings. I wanted to create a bigger audience for my material beyond my own networks in Facebook and Linkedin.

Causailty:

Anyone who designs or uses webpages will be familiar with Google's pagerank formula, and therefore if you are looking for an effective method of boosting your rank, you need to incorporate that into how you seek links to build your organic ranking. However, there are more metrics for success on the web. For instance, the number of hits, comments and the "quality" of said metrics. Keeping these goals in mind, I've been evaluating some of the tools I use to promote traffic to my website, particularly focusing on blog directories using a framework which cointains these elements and their relationships.

Architechture:

Among these blog category services, my favourite would have to be YPBlogs (Young Professional Blogs). The reason? I get good quality hits from the site is the short answer. But it's because of the subtle differences in how the site is structured (to match my goals). Let's look at the details:

- By virtue of the site's writers / target audience, it attracts a certain crowd - energetic, exuberant, intelligent and technology proficient young professionals

- You are listed on the front homepage - Unlike some of the other categories where you are listed on the 97th page among 50 other blogs on that page alone

- They enjoy a decent page rank

- It's a free service

- They aggregate most recent blog posts on their homepage making it easier for you to immediately hit the latest news (and conversely for people to hit your recent posts)

- They have dynamic content which refreshes *constantly* attracting people to return often

- Bottom line - You get good hits and comments - I have two blogs posted on their service and I swear that my traffic has doubled (Ok. Maybe my blogs are relatively new, and "doubled" isn't really that impressive, but it is certainly way more traffic than I'm getting from the other services - a more "apples to apples" comparison).

I think the most interesting point here though isn't what YPblogs has been able to do for my Blog, but rather, what it's been able to do for my blog reading habit. I've found it surprisingly difficult to find interesting blogs to read (that aren't major publications by writers who blog as a full time job). What I was looking for was independent blogs of individuals who simply wanted to express themselves or ideas and this was a great place to find material.

In the interest of full disclosure, I'm hoping to become a featured site on YPBlogs by writing this post, however, the outcome of that is uncertain as this is a post they have not solicited and I would have (or rather, have just) written anyways.

Saturday, March 21, 2009

Smart People Saying Stupid Things

The unfortunate thing is if you dissect what he was saying (between his pauses and stuttering), he was actually trying to describe the difference in message flows between Stacks (dump trucks) and Queues (tubes) and why net neutrality is important for internet traffic. How unfortunate. I pictured in my minds eye, some techno-consultant who shook his head at his message being butchered while silently crying that he would probably be blamed for this later.

As tragic (or humourous depending on your perspective) as you find this story, a good lesson here is the dilution of any message by the messenger. One of the biggest issues facing organizations is that for each additional management layer you create, the message usually loses about 20% fidelity while passing between layers (or retains 80%). So after two layers you're down to 64%. After three layers 51% and so on. Think of the childhood game of broken telephone. Or this Dilbert Comic from Scott Adams:

There are some obvious solutions. Jack Welch is a strong advocate of flat management for this very reason. The idea that being flat and having a minimal number of reporting structures makes your organization literally (and ideologically) more tightly knit and flexible.

Another is a very well organized communication plan. Messages should be unified and repeated. Changes should be well managed, but not so drastic that they violate or become misaligned with your core values. In an ideal scenario, people should almost be preemptively able to anticipate your communication. There should be few "surprises" which usually lead to things being taken out of context which further obfuscates the truth. A good example of this is technology companies and the "planned obsolescence" of consumer products.

This problem gets further compounded and exacerbated if:

- You are in a MNC - Your audience speaks different languages and struggles with understanding idioms, slang or cultural customs.

- Globalization - Issues related to distance in transmitting messages or updates.

- Lack of standards or a common lexicon - Changes in context from one department to another lead to gross misunderstandings.

- Decision cycles - Propagation of time delays from when a message was fresh to the latency after it is released for public consumption including the iterative refining process before it is approved.

- Message volatility - Chaos. Too much communication and too much changing at once. No "version control" on ideas.

- Weak culture - Unclear vision or mission in the company's core values or over arching goals causes people to constantly second guess the organization's direction and their role in it.

Friday, March 20, 2009

Developing Your Personal Brand

We've often heard horror stories of people who've been burned because of a blog post, Facebook photo or Youtube video of them doing something embarrassing, it being discovered by their boss and them getting canned over it.

People should realize by now that their online presence in the public domain can be detrimental if left un-managed. However, the other side of the coin is that a well managed online identity can bolster your image, especially as a recruitment tool.

While most applications for jobs and competitive opportunities limit your application materials (2 page resume / CV, cover letter, essays, etc) it is beneficial to have a strong online presence to supplement your materials. Without the restrictions of a standard application package for example, including a website can stretch the valuable time a recruiter looks at "You" (your personal brand identity) from the standard 30 seconds before you are placed in the "blue bin" filing system to maybe that extra few moments in which they decide you're interesting enough to call in for an interview.

Some particularly good examples? Check out Jamie Varon's twittershouldhireme.com which only started on March 9, 2009. Although she's placed all her eggs in one basket so to speak, she's already got a fairly large following (she explains on an online interview that she was one of the top followed uh... twitter-ers).

In her example, she had a unique and bold idea, great execution and strong social networking / advertising. Her story is in it's interim stage as she is being called in for an interview by Twitter, but her fan base has its fingers crossed for good news.

Thursday, March 19, 2009

Calling All Canadians - Last Chance for Cuba?

Canadians have always enjoyed (relatively) cheap Cuba vacations and cigars.

An interesting point to note, is that while Obama is beginning the healing process between Cuba and the US and is being touted as a hero, the only loser in this win-win scenario is the Canadian consumer. If the US finally starts to open its doors to Cuba and chip away at the embargo, US travelers will suddenly have a new, cheap and relatively unexplored vacation spot nearby. This is a HUGE shift in the demand curve to the right for Cuba's hospitality industry.

Possible side effects include major resort development to accommodate this demand, but demand will probably outpace supply for some time (unless there are some land developers and investors who are willing to make a relatively risky bet and start developing property now - which is difficult with the embargo still in place - maybe international investors?). Chances are this relationship will manifest as demand greatly outpacing supply for some years.

This also means that the relatively affordable rates Canadians have been enjoying in Cuba will dramatically skyrocket if they are forced to compete with their American cousins for vacation capacity in Cuba if things go well.

This of course extends as a general analogy to all things Cuban in the economy as it relates to demand from Canada and the US.

Twitter, Facebook and Software Modularity

I've also added the Twitter app to update Facebook status as well as Twitterberry, an application to update Twitter through your BlackBerry. It occurs to me how much layering is now involved in social networking.

When I update my Twitterberry application, it updates my Twitter account which in turn updates my Twitter application on Facebook which updates my Facebook status. All this in less time than it takes for my Firefox browser to refresh my Facebook homepage.

When I update my Twitterberry application, it updates my Twitter account which in turn updates my Twitter application on Facebook which updates my Facebook status. All this in less time than it takes for my Firefox browser to refresh my Facebook homepage.This is a testament to modular software design. However, as seamless as this progression appears to be, the recent updating of Facebook's "faceplate" for lack of a better word, brings up an interesting question when it comes to systems design.

Facebook was previously divided into several categories of communication: Status Updates, Messages, Wall Posts and (more recently) Comments. However, this new design begins to blur some lines (particularly between Wall Posts and Status Updates. While users may remember Status Updates as preceding with

Now, this has some users up in arms based on the user interface and online "form factor", but in looking at my old Facebook for BlackBerry app ("old" by the online versions new standards, but still the "latest version") I noticed that much of the context that made sense in the previous versions now don't make much sense at all. It's a wonder that the API still works as well as it does (legacy code probably not yet depreciated) however, it's only a matter of time before this application gets a major overhaul.

Software vendors and developers need to catch up with Web 2.0 (it's hardly "new" anymore as it's been around for years now) and understand that in the development life cycle, there are major issues associated with changing form factors and even templates when your services are so integrated and intertwined with other services.

Modularity was a nice to have when your software was standalone and you simply wanted the ability to cheaply and quickly roll out new releases of software and be flexible with passing your code from one developer to another for outsourcing purposes, however now with the interdependency of message protocols and databases, it has become a critical necessity.

Especially as enterprise customers begin to rely on social networking technologies such as Twitter and Facebook as part of their mobility strategy, software design for increasingly critical applications must be more robust.

Tuesday, March 17, 2009

St. Patrick's Day - A Time for Optimism?

Just a few moments ago, Canada reported a 5% drop in manufacturing shipments (a slowing decline - but a decline compounded by previous declines) with automotive being a big drag (without which it is a more moderate 1.2% compared to Dec according to BNN).

Remember, the stock market is a leading indicator so it will be the first place that starts to improve in an economic upswing (unlike employment which is a lagging indicator for those of you with employment issues). Keeping the fact that a recovery is expected in 6 months to a year, it might be a good time buy if you can sustain a bit of volatility.

Monday, March 16, 2009

Differentiation - A Necessary Ingredient in the Recipe for Success

Many business leaders subscribe to the idea that competition brings out our best performance. Some will even go as far as competitively ranking (by percentile) and categorizing employees. The top 20% make the A group, the super stars. The next 70% are the B group, the vital work force engine. The final C group are "mismatched", and depending on the aggressiveness of the firm, may be reprimanded, retrained or might not be employed for much longer. While such aggressive behaviour is debated by both advocates and detractors of differentiation, people who are in sales roles will know the value of being aware of the dynamics (even if they choose not to participate). And sales roles doesn't just encompass building customer relationships to eventually lead to the consumption of your products or services, but also the sale of ideas to colleagues or projects to upper management etc.

In a world with shrinking resources, global competition in all markets and increasingly skilled workers, the ability to sort out and match requirements must keep pace with the needs of the organization or consumers (whether they are individuals or corporations).

's to

's to  's

'sThis is particularly notable in a weak economy, when many people make small realizations that "paper towels are just paper towels" and slowly start to adopt "inferior" (in the economic income elasticity sense of the word rather than quality) goods versus "normal" goods. Differentiation on brand alone isn't good enough any more. Now that people don't have the financial exuberance they previously had, corporations must work extra hard to pull out that extra couple of cents from the consumer's marginal propensity to consume.

Friday, March 13, 2009

Market Net Neutral Positions

A market net neutral position is one that employs a long / short strategy such that the investor has no cash position in the market. That is to say that the cash obtained from the short position is used to support the long position (100 / 100).

In the same way, profit is made when the price of the long position grows at a rate faster than that of the short position. If the short position loses money, your profit margins are amplified. The same obvious risks apply: a bad bet and that the short position will grow faster than the long position.

Other variations include the idea of market growth leaders: Being long in a market growth leader's stock and being short on the market index. This bet is essentially saying that you think this company will grow, but you want to hedge against a general decline in the market sector.

Thursday, March 12, 2009

Is Globalization and Outsourcing "The Devil"?

Many altruistic people are comfortable drawing parallels between our lifestyle versus those of developing nations, akin to: "You should be happy with what you have compared to what poor people in other countries have." I would propose that responsibly exporting components of success that lead to a shared and similar lifestyle is the first step towards achieving that dream.

While good intentions are the motivations at the start of the journey, it is necessary to have the engine to drive you there which I propose is the idea of fair trade and responsible globalization.

I think that if you are aiming for the noble goal of global equity (as the aforementioned statement assumes) than you will have to rely on some degree of globalization to happen. And as with anything, a good idea can be poorly applied if the implementation is not well planned.

I do believe that globalization is inevitable (for better or worse). Furthermore, I perceive the inequities in terms of purchasing power and lifestyle as inherently unstable scenarios that free trade should theoretically begin to remedy. However, I can understand an activists concern at the potential (or rather, historical) of exploitation of poor foreign workers (or even "opportunistic disaster capitalists" as Naomi Klein describes them in her book Shock Doctrine) which subsequently also results in lost jobs in home countries. While the opposite strategy would be considered protectionist, this strategy certainly seems reckless, benefiting only a select few based on morally weaker ground and attracts negative attention.

The focus should not only be on exporting the engine of capitalism, but also the standards that come from more developed countries in terms of workers rights and democratic process that should go with it. This is to bring a more broader definition of success and prosperity into an economically (and potentially politically) less developed country.

Any company that attempts to outsource without taking these issues into consideration will certainly struggle as consumers and workers demand more corporate responsibility from their leadership and insist that company's stick to their stated core values.

Assuming a more optimistic tone, a corporation that is sensitive to these issues will not abandon globalization, but will rather do it in a more responsible fashion. The economic assumption from free market and supply side advocates is that a company opening a new factory in an area should be increasing the labour demand curve and as a result raise the wages of the local populace. While a rise in real wages is a great metric for describing success, what is more important for the population at large in this case is that the entrant companies are providing options for local workers.

That is to say, if current workers are unhappy with their working conditions in their current jobs, this new opening will need to provide them with incrementally better opportunities in order to attract them from their current positions or to fill a vacuum of unemployment. This is the opportunity that foreign companies can and should offer to locales where they open new operations.

For companies who are constantly looking for differentiation, this leads to the obvious marketing and PR component. In this day and age, it is simply not enough to do social good without having an open and frank discussion about it in public (in a closed loop communication system). Corporate communications should proclaim their messages of good faith coupled with their good deeds so that the public can transparently judge them based on their actions.

Wednesday, March 11, 2009

Real Good News or a Blip? Citigroup posts profit.

But what does this all mean? Is this real good news and will the price finally get some sticky upside or is this just a blip on the radar?

After all, even the most optimistic economists and pundits weren't predicting a recovery this soon (remember Canada's Minister of Finance, Jim Flaherty's comments about the expected recovery?). The markets across the board started to uptick, but there have been so many false positives that it's hard to gauge what the "true" direction is. Especially with such short windows preceding the good news, it's tough to see how other banks will be doing.

Analysts should be cutting up Citibank's books to verify the authenticity and strength of Vikram Pandit's comments regarding Citibank's fiscal strength.

Monday, March 9, 2009

Deleveraging As a Strategy - Review and History

When you go short stocks and long bonds to deleverage, if what you predict becomes true, you'll also make a profit when capital rushes from one asset class to another. With demands for bonds rising, the yields will fall and prices will rise so your bond will become more valuable also (capital appreciation).

We may remember Warren Buffet's notoriously correct (but poorly timed) shorting of tech stocks. Although he was right, he lost a lot of money leading up to the burst of the bubble by employing this strategy.

With this historical perspective in mind (of a seasoned investor making a similar gamble) I would presume that a strategy that utilizes this technique probably has an incredibly high Sharpe ratio and at the end of the day probably isn't worth it. It requires too much foresight and insight into behavioural finance which, if the recent economic problems are any indication, might as well be black magic. Dealing with derivatives is hard enough. Dealing with derivatives that depend on emotional factors and exhuberance is crazy.

Facebook: Privacy and Broken Business Models

Even recently, Facebook had to retract changes made to their ToS because of IP issues associated with the changes. As they look for creative ways to make money from their services, they have to come to terms with the initial strategy with which they were originally modeled.

Because of this initial definition of their space, they are having difficulty when it comes to leveraging their extensive network. Their network size is larger than MySpace, but their revenue is struggling to match their growth pattern.

Using an advertising model to make up most of their revenue, Facebook users will notice that their interface has become plagued with irrelevant ads (IQ tests, get rich quick schemes and all the garbage we hated on other parts of the net).

They should be leveraging their "intimate" knowledge of us for more targeted advertising. This has already started to appear in its infancy as a form of social advertising: Your friend, X, has joined the Y group or become a fan of Z product (with the implied suggestion that maybe you'd also be interested). There is potential here to do more direct communication with your fan bases in a similar vein as a membership or frequent purchasers program.

Also as differentiated products and brands can also be a form of self expression. Actively becoming a member or fan of such products on your social networking site become a natural extension of this expression. Marketing Mavens in the community can create a "celebrity endorsement" in their communities by proclaiming their interest in certain products by signing up for and participating in these fan memberships and groups.

These fan memberships and groups also provide focused and attentive groups for targeted communication. They are a captive audience eager to consumer your products but more importantly are interested in learning more about updates or possibly participating in feedback relating to these products.

This greatly affects current advertising models as well as how corporations solicit feedback and communicate with their loyal customer bases.

This may be good solution and business model to follow which allows Facebook to have it's privacy cake and eat it too. For now it seems like this type of model is rapidly gaining popularity as a nice to have, but could very quickly become a necessity for businesses who want to stay in close quarters range of their customers.

Sunday, March 8, 2009

Sunday Reflection: Elasticity - Price Anchoring and X backed Y's

Wheat and corn supply needs have very similar characteristics. The primary ingredients are land, labour, fertilizer, weather etc. Now I'm sure there's probably an intrinsic ratio describing the value of wheat to corn (although I'm not sure what it is... Although it's probably directly proportional to the amount of land required). The assumption is that from a farming perspective, you can describe the production of these products strictly as consumption of the primary supply resources with a high correlation between the inputs and the outputs and they are intimately related.

Now from a financial perspective, you can take this operating relationship and extrapolate that since the supply is so interrelated (there exists a relationship where their supply attributes are almost perfect substitutes for each other) you would anticipate that there is a natural price ratio that should always exist between them, even if on the demand side people prefer consuming corn over wheat 10 to 1 (perhaps ethanol fuel becomes increasingly popular driving up demand of corn). But the price ratio between them should still be the same. Why is this?

As the demand for corn increases beyond the equilibrium point, between bankers and farmers, there should be an obvious opportunity to profit by "arbitraging" the increase in the price of corn. Essentially, both bankers and farmers would slowly change their positions: becoming long corn and short wheat. For farmers, this would mean converting land from growing the previous equilibrium levels of corn and wheat to the new equilibrium introduced with the increased demand. Although this shifts the respective supply curves, this should restore the price of both commodities to within their natural intrinsic value ratio. In this way, the price of corn is anchored against the price of wheat and vice versa.

This is exactly the same relationship many world currencies used to have with gold. When the US government had the gold backed dollar, each dollar of currency was essentially a certificate of deposit on a quantity of gold held by the US government. In that way, price fluctuations in the value of the US dollar were stabilized on the world market because of the stability of gold.

However, now because this is no longer the case (US dollars were taking off the "gold standard" in 1973) the US dollar fluctuates much more (especially when the government must print more bills, diluting the value of each individual bill, in order to maintain its spending programs in recessionary times). The aforementioned relationship is particularly notable in this case, because dollars and gold shared many important characteristics were very interchangeable as stores of value (although perhaps not as much for mediums of exchange - few people make purchases with gold).

There has been a lot of buzz about the deflation of the dollar, especially after the recession is over as the debt spending to get out of the recession catches up with us. Although people are more concerned about job growth and stimulating the economy, it would be foolish to ignore the next hurdle on the horizon.

Friday, March 6, 2009

Deleveraging As a Strategy

While many people were applying leverage to obtain higher returns from equity, contrarian investors with a great deal of foresight could have applied deleveraging as a strategy.

Deleveraging has traditionally be used as a moderate hedging strategy in order to offset tax claims, however, in this scenario, it could have provided a great profit. Here's how it works.

Leverage is simply borrowing money to buy more of a stock. The profit potential arrises when the stock appreciates faster than the interest yield (owed) on the loan.

A contrarian investor notices a great deal of leveraged activity in the market. Seeing a bubble beginning to form outside of a reasonable valuation for these equities, the investor takes a short position against the equities. The cash provided by this short position, the investor would put back into the market in the form of a bond.

By taking this position, the investor can arbitrage the debt out of the security to bring it back to expected level. The profit is made from the short position when the stock price starts to drop (because it's over sold) and also from long position in the bond from the interest collected.

Inherent risks in any position is if you guess wrong. In this case, if the stock price goes up faster than the interest collected by the bond. This would imply that the market still has some room to apply leverage.

Thursday, March 5, 2009

Searching for the Bottom

As have repeatedly mentioned, prices in the 52 week high or low category are at the extremes of stock prices. Consider this graph below:

Today is represented by the leftmost point. In other words, this graph hasn't 'happened' yet. Assume that this is an optimistic view that this is the potential future of the stock you are analyzing. This assumption requires the belief that the stock will not stay down forever (a key point here, however, is that the time quantiles are not defined, that is to say we don't know how long it will take for this pattern to emerge). You can see some clear trends and spreads which emerge in the diagram below:

Today is represented by the leftmost point. In other words, this graph hasn't 'happened' yet. Assume that this is an optimistic view that this is the potential future of the stock you are analyzing. This assumption requires the belief that the stock will not stay down forever (a key point here, however, is that the time quantiles are not defined, that is to say we don't know how long it will take for this pattern to emerge). You can see some clear trends and spreads which emerge in the diagram below: The question I would like to propose is what is the best price to buy the stock? Instinctively, most of use would probably say at the very bottom of the through (at the very beginning of the second trend segment - the price stabilization point). However, I submit to you, that even if you could model the stock with extreme precision and pin point the bottom of the stock price valley, and even if you submitted an order to your broker who was exceptionally skilled, unless you yourself were sitting at a Bloomberg terminal with special trading hotkeys for one touch execution (such as those on the trading floors at major institutions) you would not stand a chance of getting in on the "ground floor"). Let's look again at the stock price, but using a more statistical analysis approach:

The question I would like to propose is what is the best price to buy the stock? Instinctively, most of use would probably say at the very bottom of the through (at the very beginning of the second trend segment - the price stabilization point). However, I submit to you, that even if you could model the stock with extreme precision and pin point the bottom of the stock price valley, and even if you submitted an order to your broker who was exceptionally skilled, unless you yourself were sitting at a Bloomberg terminal with special trading hotkeys for one touch execution (such as those on the trading floors at major institutions) you would not stand a chance of getting in on the "ground floor"). Let's look again at the stock price, but using a more statistical analysis approach: Here we can see a more clear picture. The 52 week low occurs only once. Whereas purchasing a stock at any price below or near the lower trading band is common (almost two thirds of the total time window shown here). Also, the stock is entirely below the intrinsic value we modeled.

Here we can see a more clear picture. The 52 week low occurs only once. Whereas purchasing a stock at any price below or near the lower trading band is common (almost two thirds of the total time window shown here). Also, the stock is entirely below the intrinsic value we modeled.The challenge here is if you can have the foresight to correctly model the price of the stock using the appropriate valuation tools, you can maintain a relatively safe position while you wait to the stock to go up. The only problem with buying too early is that there is a bit of stomach turning as the price drops as well as the time elapsed between when you buy and when you start to see positive returns.

Wednesday, March 4, 2009

Sustainability and a Green Focus

I would propose that the most base definition of sustainability should relate directly to energy capture and consumption. However, since products cannot simply be arbitraged nor modeled directly as energy consumption, there are many other aspects which must be considered: carbon emissions, land use, natural resource extraction rates etc.

It is quite obvious that anything which is consumed and not replaced is in an inherently unstable relationship. Currently, companies such as Monsanto are working "diligently" in order to increase the yields of products we consume (in Monsanto's case, GMO food products) as a solution to assuage the strain and diminishing return of our resources. However, even the most cynical and fastidious capitalists must recognize that there exists some natural limit of efficiency (even with technological augmentation).

Biotechnology growth has recently spiked up as a result and its now up to companies to find out what that means for them. How should companies incorporate business practices so that they can benefit from this inevitable trend. While some companies are contributing at the forefront with new innovations in resource management, other companies will have to find which services they can provide or will demand in the future. Whether these companies are innovating to create substitutes or trying to increase the efficiency of how we use our resources, sustainability management will likely become an increasingly popular (and necessary) field.

Daydreaming and Buyers Remorse - Using the right metrics

Also understand this. Do you know how many trades were made at the 52 week high (or low)? One. That was the last trade before the price started moving back towards it's equilibrium price.

Let's take a look at the stock chart below. Look familiar? It should. Almost all stocks on the market have exhibited similar behaviour:

That heavy drop would have made it's appearance at different parts of last year depending on what industry sector your company was in, but this shape is fairly common (unfortunately). The next graph we add a moving average trend line for technical analysis purposes.

That heavy drop would have made it's appearance at different parts of last year depending on what industry sector your company was in, but this shape is fairly common (unfortunately). The next graph we add a moving average trend line for technical analysis purposes. Finally we highlight our 52 week highs and lows.

Finally we highlight our 52 week highs and lows. I think the next portion is the most important (and the overall lesson), is that aiming to hit the 52 high and low is ridiculous. Even the most advanced traders would probably be happy making a reasonable spread between the upper and lower trading bands shown here. For mathematical purposes, assume that they are only one standard deviation from the mean. And for assumption purposes, assume that the mean is the intrinsic value of the stock (what it *should* be worth)

I think the next portion is the most important (and the overall lesson), is that aiming to hit the 52 high and low is ridiculous. Even the most advanced traders would probably be happy making a reasonable spread between the upper and lower trading bands shown here. For mathematical purposes, assume that they are only one standard deviation from the mean. And for assumption purposes, assume that the mean is the intrinsic value of the stock (what it *should* be worth) Assuming that you trade within the band, your volume will cover 68.2% of all the trades (one standard deviation) and you'll make a hefty profit (especially if the stock's volatility is high).

Assuming that you trade within the band, your volume will cover 68.2% of all the trades (one standard deviation) and you'll make a hefty profit (especially if the stock's volatility is high).You can also do a trade off between profit and risk if you narrow your band (to say, half a standard deviation). In the extreme (of small margins and high volumes) the sales and trading technique is known as 'scalping'. Granted that these statements assume that your valuation model can identify these parameters, but even if you can't get exact parameters, the concept still holds (stronger precision and accuracy will provide stronger profits).

A critical observer would also note the following: "But what if the 52 week low we see here isn't the bottom?"

That is the topic of my next post: "Searching for the Bottom"

Tuesday, March 3, 2009

The Hiring Process

I don't think anything drives this point home more than a recent job fair I went to in Toronto where the line up went out the door and across the floor of a crowded convention hall to meet up with a hand full of employers, only a fraction of which were actually hiring. Although these employers can have their pick of the litter, it becomes very difficult to sort the wheat from the chaff.

The recruitment process, a process like any other, has many metrics which can be used to determine it's success rate. Recruitment and hiring can also be evaluated at different stages to understand the relative performance and contribution of each stage to the overall success of recruitment efforts. First let's take a high level look at the recruitment process:

Recruitment Events:

Recruitment Events:Although it would be perfect for recruiters to be able to attend all recruitment events with potential candidates, the reality of the situation is usually that there is a limited staff and budget. This in turn means that recruitment teams have to prioritize their attendance based on their recruitment goals and needs. Similar to a targeted marketing campaign, HR recruiters need to advertise to their perspective new hires to get them interested in applying. A valuable metric to evaluate for this stage is how many applicants applied and how did they find out about the posting. While job boards like Monster.com might have a swarm of applicants, the quality and relevance of each applicant might not be of the caliber or fit you are looking for.

Application Process:

The problem with recruitment today (especially in this climate of high unemployment) is that there is usually an insurmountable number of applicants. The application process needs to be able to navigate through the clutter, however, it also must be concerned with disguarding good candidates. Even the best tools in this area will appear as double edged swords. The application process is usually as follows:

- Application materials are screened by an automated process (Resume / CV, cover letter, references, transcripts)

- Recruiters pick out top candidates for a first round interview. In this interview, the recruiter does a pre-screen for fit within the company, behavioural interviews, and leadership / soft skills assessment etc.

- If the candidate passes, they are then passed along for a second interview, usually with the hiring manager or colleagues for competencies and technical skill.

- A subsequent interview may follow by a senior executive for long term potential within the company and final approval.

Many companies have referral programs which aim to quickly identify good quality candidates. These pre-existing relationships act as a pre-screen for candidates as current employees vouch for their ability to perform the roles. It has often been said that 80% of all jobs are found through networking. Some companies even provide an incentive for employees by offering a referral fee for candidates who are extended an offer.

At this stage, it is also important for companies to evaluate the process and individuals participating in what Jack Welch calls the Hiring Batting Average. It's essentially a review of the success of your company's recruitment team to ability to identify and hire star employees at each stage. Those who are proficient should continue to be involved (or escalate their involvement) while those who are less successful need to improve their "batting averages" or be taken out of the process.

Candidate Offers:

Hopefully, by this point there are few hiccups in hiring process. However, for highly skilled or demanded candidates, there may still be the need to negotiate terms, benefits and salaries. If you offer competitive salaries, you will not lose as many good candidates to other companies (and retain them for longer also). Looking at your compensation system and ensuring that it is aligned with your needs and value proposition as an employer of choice.

Hired!

By looking at all of these items independently and as a whole, companies can make the most of the resources they have in order to provide the most benefit for their operational teams. In an environment where more is being demanded with less, it is crutial for all members in a company to operate at their most efficient levels. Especially the component which is responsible for adding more memebers.

Elasticity - Inferior Goods - Opportunity for Observation

Having said that, theoretically, what should our studies in this area have told us to predict?

Elasticity is a function of our anticipation of price movements. If we expect prices to fall, our consumption will drop as much as our elasticity will allow. For instance, if you plan on making a purchase of a good, if you expect it to be cheaper (in real terms) tomorrow rather than today (and you can wait), chances are you will buy it tomorrow. If you expect that the price will see a dramatic rising tomorrow, you will buy as much today as you can reasonably stockpile (assuming your product's life expectancy and expiry is aligned with your consumption habits - you'll "front load" your consumption). A good example of that is TTC token sales and hoarding rules before an expected price increase.

Also, your consumption of various goods will also depend on the "weight" of consumption as expressed as a percentage of your total income. For instance, your consumption of rent (or mortgage) is probably your largest outlay. Most of us will probably compromise on the size of the apartment we rent (or the house we buy) in order to stay on budget and are more sensitive to price changes here because a small percentage change in the price reflects a large percentage change in our total consumption.

There is also the idea of "inferior" goods. The typical examples are small motorcycles, rice and potatoes, public transit etc. The idea is that these uniquely positioned products have a negative relationship with income elasticity. What does that mean? Unlike normal goods where an increase in income generally increases demand, inferior goods actually become less popular (contra their substitutes) when income goes up. If you make more money, you'd probably stop taking the metro and start driving.

In an environment where people are losing benefits, taking pay cuts or flat out losing their jobs across the board, it would be interesting to see the economic effect on the purchases on some of these goods in some form of "inferior goods" index as a measure of general economic hardship. This might be one area which would actually benefit from economic recession.

I hope I don't appear like I am profiteering, but I think that the best way to get out of an economic crisis is to find the bright spots and leverage them (I don't mean "financially leverage" - not taking out loans to buy the stock, I mean strictly in the strategic sense) to being our slow climb out of the recession. Essentially, I'm trying to identify places which might do well in a recession, places with these qualities that would probably increase their hiring and slowly bring spending back up (along with consumer confidence).

Monday, March 2, 2009

Local Coffee House Profit Conundrum

A local coffee house was looking at its books and noticed that it's profit margin for the last quarter were down. This was a seemingly large contradiction and interestingly confusing to the management, who decided to investigate further as growth had been fairly steady. In fact, their intuition told them that they had more customers these last few months than usual. Let's use the Rotman School's Integrative Thinking model to break down the problem.

Salience:

In breaking down the their profit model, they were certain that their cost model was the same: Despite the fact that there was more traffic coming to the store, they had not changed their hours or personnel per shift. Standard supply side items such as rent and food and beverage suppliers had not changed and there were not any large capital outlays for new equipment nor maintenance.

In investigating the revenue side of the profit function, very little had changed as well. The product prices had remained the same and volume had even gone up recently.

Causality:

However, upon inspecting the volumes of each types of products purchased, it became apparent to the management that there was less people dropping in for snacks. There was a steady strong demand for lunch products such as sandwiches, but a decline in the demand for coffee, a high margin product.

As a result there was also a shift in the peak periods from the 10 am to the noon hour, when a local university's students were let out of their morning classes for lunch.

Architecture:

To identify how to build a framework around the issue, the management team looked at the causes of the drop in profit margin and looked for opportunities and strategies to capitalize on this new dynamic.

By identifying this shift in consumer behaviour, there is an opportunity to better align their services with their new client base to serve them better.

Resolution:

Based on this demographic shift, there was a higher demand for their lunch products and potential to develop a more robust menu beyond the limited offering they were currently providing.

There also exists the possibility to shuffle the shifts to meet the change in demand from the shift in the clientele and to adjust their inventory sizes accordingly to minimize inventory carrying costs and spoilage.

Sunday, March 1, 2009

Sunday Reflection: Supply and Demand Curves to Describe Equity Prices

Savers (with net positive capital) represent the demand curve for investment vehicles, while companies issuing various investment vehicles (net negative capital) represent the supply curve of investment opportunity.

Savers (with net positive capital) represent the demand curve for investment vehicles, while companies issuing various investment vehicles (net negative capital) represent the supply curve of investment opportunity.The float or the number of outstanding stocks actively traded at any given time, would be described as quantity supplied / demanded where the supply and demand curves meet. Note that unless there are additional shares issued (or a company stock buy back) the supply curve is relatively inelastic.

Trading volume and price would be represented by incremental movement of the qs / qd equilibrium (notice that for every transaction, there is a buyer and seller of the same product so the qs /qd immediately returns to its equilibrium point) and it's associated price movement.

Substitute products for equity class assets include fixed income instruments such as bonds, mezzanine instruments such as preferred shares or others investment vehicles.

IPO's or secondary offerings would be represented by a right shift in the aggregate supply curve (more supply and options for investment vehicles)

Companies going bankrupt would be a left shift in the aggregate supply curve (less supply).

The aggregate demand curve (and movement in it) would most likely be caused by growth in the wealth of the general population (more wealth means, more saving and more demand for investment vehicles) manifesting as more people putting money into the market.

Finally, "financial innovation" usually describes a method of artificially boosting the one of the market's economic curves. Previous examples include: RRSP or 401k qualified purchases of stocks (demand right shift - releasing more cash into the market), and the more recent (and disastrous) recursive packaging of various CDO trenches (supply right shift - providing additional places to put your money to maintain growth).

Now that we have all the pieces, how can we use this to describe the current economic crisis?

While the market was super hot, bankers had to look increasingly harder for new investment vehicles which could potentially give the same return. This has lead to the poor lending practices we so often hear about where banks were loose with their money in the housing market. These housing loans were collateralized to redistribute the risk and parceled out to investors.

When these bad loans started to default, people started to panic as they realized that what they had bought wasn't investment grade (as they had be lead to believe) but really just junk.

Then people start to liquidate their positions and the demand curve for that asset class takes a huge shift to the left dropping prices in equities across the board. It is very hard for the companies to match this movement (as a left shift in supply means they are rapidly becoming smaller) and supply is relatively inelastic in this scenario. Unless the company is delisted or otherwise has its stock forced off the market, there remains an oversaturation with the number of stock issues.

However, all this capital flowing out has to go somewhere. This is the "flight to quality" that everyone hears about, where people take their money out of risky asset classes (such as equity) and start dumping them into more stable US government T-bills or bonds (or stocks in defensive companies). This causes a huge right shift in the demand curve of that asset class and the prices skyrocket.

As an Engineering student, I've always believed that "You can cheat on your exams, but you can't cheat physics" as a good lesson and warning for those who would try less scrupulous methods to succeed. However, even in investing where the science is greyer and mixed with equal parts art, it's both reassuring and telling that the laws of gravity and science of economics still hold.