Thursday, April 30, 2009

PEST Analysis

Political factors examine how and to what degree a government participates and intervenes in the economy. Specifically, political factors include areas such as tax / subsidy policy, labour laws (minimum wage, safety regulations etc), environmental regulation, trade barriers and tariffs, and political stability. Furthermore, governments have great influence on the health, education, and infrastructure of a nation.

Economic factors include macro-level economic factors such as economic growth (GDP), interest rates, exchange rates, the inflation rate and unemployment rate. For example, interest rates affect a firm's cost of capital and therefore to what extent a business grows and expands. Exchange rates affect the costs of exporting goods and the supply and price of imported goods in an economy.

Social factors include the culture, education level, health, population growth rate, and age distribution. Trends in social factors affect both internal and external factors in the company including the demand for a company's products or services (what the public in that geography demand) and how that company operates (who is available to be hired from the pool of workers).

Technological factors include R&D activity, automation, the rate of technological change as well as the current state of technology (i.e. communications infrastructure). They can determine barriers to entry (patent law) or provide strategic leverage.

By looking at all these factors, an analyst can determine the relative attractiveness of looking at different geographies from a macro-perspective. From a top-down approach to strategic thinking, a PEST analysis is a rudimentary starting point for any decision making.

Wednesday, April 29, 2009

Urban Planning and the Irony of Mass Transit

Particularly, with a mildly satirical tone, I wanted to look into the phenomenon of clustering. In other words, I wanted to answer two questions:

- "Why do I always seem to miss buses in pairs?", and

- "Every time I try to ride the bus, why do I always get the full one?"

To understand what I mean, let's assume:

To understand what I mean, let's assume:- A bus route to a main station has five equally distanced stops A, B, C, D and E.

- The distance between stops (described as time to traverse from one stop to another) is 2 minutes regardless of traffic and other factors.

- It takes 2 minutes to load a bus at each stop regardless of number of passengers, unless there are no passengers (or the bus is full) in which case the bus travels "express mode" and doesn't stop at all.

- A bus can hold 50 people maximum.

- That each stop has 15 people (total 75). It will take 2 buses to pick up all the passengers.

Notice that whatever the interval between buses (say 15 minutes) is the minimum wait time that the passengers at D and E have to wait for the second bus (on top of normal travel time if they could get one bus 1).

The travel time for each group is as follows:

Bus 1 (containing Passengers from A, B, C and 5 from D) arrives at the terminal after 18 minutes

Time = 2 min per stop x 4 stops

+ 2 min drive time between 5 stops

Bus 2 (containing the remaining passengers from from D and E) arrives at the terminal after 29 minutes

Time = 2 min per stop x 2 stops

+ 2 min drive time between 5 stops

+ 15 minute delay between Bus 1 and 2

Generally,

Travel time for any given bus = time spent picking up passengers (delay per stop x number of stops)

+ time spent driving between stops (travel time per stop x number of stops)

+ time delay between buses (anticipated wait time for a passenger who 'just missed the bus')

Notice that in this model, a bus that follows another will have a more "efficient route" excluding the delay time between the buses (currently set at 15 minutes) if the delay is less than 11 min, Bus 2 arrives before Bus 1! This is because Bus 1 (assumed to have "first dibs" on the passengers) will be held up in "transactions" picking up passengers.

Scenario ii What would happen in an incremented step by step analysis (if the two buses left at the same time) is as follows:

- Bus 1 picks up all passengers at A (2 min) while at the same time

Bus 2 travels to stop B (4 min). - Bus 2 picks up all passengers at B (2 min) while at the same time

Bus 1 travels to stop C from A (4 min). - Bus 1 picks up all passengers at C (2 min) while at the same time

Bus 2 travels to stop D from B (4 min). - Bus 2 picks up all passengers at D (2 min) while at the same time

Bus 1 travels to stop E (4 min). - Both buses run "express" to the terminal

Both Buses 1 and 2 arrive after 12 min (they share the load equally). This is what happens during non-rush hours and I would describe as "clustering", the phenomenon where buses (even when they start at different times) start to travel together.

As you can tell, this is a horrible situation when it comes to urban planning. For most lines, this means that even if you deliberately stagger buses so that they are 15 minutes apart (assuming that this is also the minimum amount of time someone would have to wait between buses), the truth is that with clustering on non-rush hours it is more likely the wait will be double that (because one bus will naturally catch up with the other if there isn't enough traffic). Hence the answer to: "Why do I always seem to miss buses in pairs?" is because they have a natural tendency to cluster.

Also, implementing queuing and network traffic theory, you can use the analogy that each bus stop is a server node and each bus is a service arrival.

This shows, as in the first scenario (Scenario i), that buses that lead are full. Assuming that occasionally when a few people get off at later stops (rather than waiting for the terminal) this is the only circumstance when a bus frees up more capacity to take on more passengers (also why they ask people to leave from the rear and board from the front). Hence the answer to: "Every time I try to ride the bus, why do I always get the full one?" is because during rush hour, most buses are full to capacity and only buses with marginal capacity available (almost full) stop to pick up more passengers.

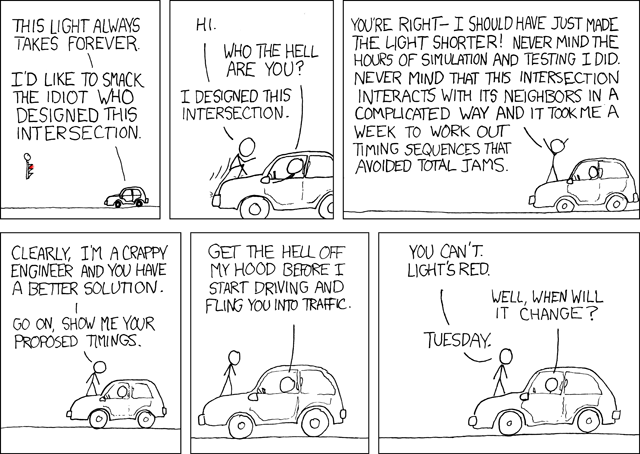

Now the system described here only describes an oversimplified one line system. Imagine multiple inter-related lines, time sensitive with daily cyclical traveler arrival patterns, complicated with traffic congestion, traffic lights, construction and other "features" interacting on the road. You certainly can't just throw more buses into the system if you want to improve performance. And we can certainly sympathize with both the Traffic Engineer as well as the person in the car in this xkcd comic:

Tuesday, April 28, 2009

UAW and Washington to own GM and Chrysler

The UAW is also looking to purchase up to 55% of Chrysler, with Fiat taking 35% and the rest picked up by the U.S. government and others. I think this is now an extremely exciting area to watch. The union essentially owns the company now with a controlling share and it will be interesting to see what happens next.

As I had previously mentioned in a post earlier this month, I wondered what would the next steps Chrysler would do to save themselves. I am happy to see the union pick up more ownership of the company. Although the unions had made some concessions, they were able to negotiate such that no changes were made to base pay while they gave up some other benefits (tuition reimbursements etc).

The capitalist markets seem to be doing what they are supposed to (despite the intervention of government) by lowering capacity of businesses that are becoming less relevant. However, I also understand the public's general concern when something in which a lot of value is built in over a long period of time begins a precipitous decline. This is exactly what Chapter 11 restructuring is supposed to do.

While I am happy with the proposed improvements, they are hardly out of the woods yet.

Oracle to acquire Sun Microsystems

By becoming a new (bigger) giant in the industry, even Microsoft, the preeminent giant, has more to worry about with Oracle's new acquisitions giving new fuel to software competition with OpenOffice vs Microsoft Office, Java vs .Net, and MySQL vs MS SQL being the most interesting ones (Solaris versus Windows might not be so exciting).

Admittedly, after having mentioned these points, it still becomes apparent that Oracle has it's work cut out for them. Although they have now gained a strategic advantage to compete with the big boys (IBM, MS) they still have a lot of work to do to ensure that they keep the right pieces of the puzzle and determine what to keep and what to toss from the combined company. For instance, there is a lot of brand equity in Sun and continuing the use of both logos is implying the continuity of its business lines (if only to garner public support).

For instance, there is speculation that Oracle will sell off Sun's Hardware divisions to a partner like HP. Although analysts say that Oracle will do this to reduce "historic margins", I think that might not entirely be a good idea. There is a strategic advantage to being a one stop shop and entrenching your products with customers is an adtantage that IBM has and appreciates. It will be interesting to watch this play out.

Monday, April 27, 2009

Michael E. Porter's Five Forces - Industry Competitive Analysis

Porter's five forces analysis looks at:

Another way of looking at this is a 360 view around your company's position in an industry. This includes your supply chain (vertical view of suppliers and customers) as well as within your market (horizontal view of entrants and substitutes). Each of Porter's four mutually exclusive forces contribute to the over all competitive rivalry in an industry.

Another way of looking at this is a 360 view around your company's position in an industry. This includes your supply chain (vertical view of suppliers and customers) as well as within your market (horizontal view of entrants and substitutes). Each of Porter's four mutually exclusive forces contribute to the over all competitive rivalry in an industry.This helps you answer the question, "Should we start a new venture in this industry?"

Let's have a closer look at each category:

The threat of substitute products The greater the number and the closer substitute products imply an increase the propensity of customers to switch between alternatives (high elasticity of demand).

- buyer propensity to substitute

- relative price performance of substitutes

- buyer switching costs

- perceived level of product differentiation

The threat of the entry of new competitors Inefficient or overly profitable markets will attract more firms and capacity investment. More capacity results (for under served markets) results in decreasing profitability. The markets will always seek equilibrium even if that equilibrium is artificially imposed by barriers.

- the existence of barriers to entry (patents, rights, etc.) - Note the expiry of patents can trigger new a equilibrium and competition rivalry movements in the industry

- size - capital requirements and economies of scope

- brand equity

- access to distribution

- learning curve advantages - required skill

- government policies, regulations and licensing requirements

The bargaining power of customers Also described as the market of outputs. The ability of customers to put the firm under pressure and it also affects the customer's sensitivity to price changes.

- buyer concentration to firm concentration ratio

- degree of dependency upon existing channels of distribution

- bargaining leverage, particularly in industries with high fixed costs

- buyer volume

- buyer switching costs relative to firm switching costs

- ability to backward integrate - can customers do this themselves?

- availability of existing substitute products

- buyer price sensitivity

- differential advantage (inimitable characteristics) of industry products

- supplier switching costs relative to firm switching costs

- degree of differentiation of inputs

- presence of substitute inputs

- supplier concentration to firm concentration ratio

- employee solidarity (e.g. labor unions)

- threat of forward integration by suppliers relative to backward integration by firms

- cost of inputs relative to selling price of the product (profit margins)

The intensity of competitive rivalry For most industries, this is the major determinant of the competitiveness of the industry. Sometimes rivals compete aggressively and sometimes rivals compete in non-price dimensions such as innovation, marketing, etc.

- number of competitors

- rate of industry growth

- intermittent industry overcapacity (like the service industry)

- exit barriers

- diversity of competitors

- informational complexity and asymmetry

- fixed cost allocation per value added

Each of these sections are scored and collectively analyzed to understand the competitive forces in any given industry. This framework highlights the key factors which determine any industry's overall competitive rivalry (and attractiveness). Industries which are not competitive may be attractive for other companies to enter (or increase investment), industries which are overly competitive may force out weaker companies and would generally be unattractive for new ventures.

Price to Sales - No nonsense double check

While that may be true from an earnings perspective, it isn't necessarily true when it comes to revenue recognition (aggressive mark-to-market or accounts receivable practices are still in the realm of management discretion and can affect reports sales numbers). Sales are a fundamental driver of business performance. However, they are not immune to tampering or manipulation.

[Case Study] For instance, in the internet boom, many "revenue" streams were recorded between growing internet companies who were simply bartering services (usually advertising revenue). They reported incredibly high (and growing) revenue streams despite the fact that no money changed hands (and the actual value of services exchanged was highly questionable). This lead to the inflation of the price of their equity and P/S would not have detected this inflation. This compounds the error caused by the fact that sales revenue was a primary metric in valuing internet companies. Anyone who neglected this truth (almost everyone, except investors like Warren Buffet in his correct but unfortunate short position timing) eventually paid for it when the internet bubble burst.

Also, P/S is meaningless without understanding profit margins (what did it cost the company to get those sales). One disastrous application of P/S I've encountered is in valuing a growing company. In it's early stages, a company had great profit margins but weak sales. In it's growth, sales grew dramatically, making the P/S look incredibly attractive. However, the profit margins weren't stable and as a result the company was not profiting as much as the P/S would suggest.

[Case study] This was the case with Surebeam and their product of irradiated hamburgers and the position Roberto Mignone takes as explained in Hedge Hunters. Surebeam's product initially had strong sales, but upon further investigation by Roberto's team, it was discovered that they were using discounts of as much as 20% to attract customers (destroying their profit margins relative to other similar products). A P/S ratio would have indicated that Surebeam was a good buy (as many on Wallstreet believed) which turned out to be disastrously incorrect.

I would propose that P/S is a ratio that is generally useful only as a secondary check. It should be done in tandem with a PE and EPS analysis to identify if any profit smoothing techniques have been used by management as an indicator of future trouble brewing.

Sunday, April 26, 2009

How We Decide, by Jonah Lehrer

However, Jonah eventually starts to venture into new ground when he begins discussing moral decision making.

His highlights the key take aways of his book, the most important being to "think about thinking":

Whenever you make a decision, be aware of the kind of decision you are making and the kind of though process it requires.Specifically:

- Simple problems require reason.

- Complex problems benefit (ironically) emotional decisions.

- Novel problems require reason - analyze underlying patterns to find solutions.

- Embrace uncertainty - deliberately contrarian hypotheses to avoid discounting uncomfortable yet material facts.

- You know more than you know (paradoxically) - emotions may often be hard to analyze, but they can provide a wealth of information if you know how to use them and when to trust them (and what their limitations are).

- The best decision making requires analysis and emotions and the best decision makers will have a mixed approach, knowing when to use which.

Sent from my BlackBerry device on the Rogers Wireless Network

Thursday, April 23, 2009

The Irony of Arbitrage, Efficient Markets and Equilibrium

One the one hand, they need to vigourously search for arbitrage opportunities to exploit. However, the harder they look collectively, the less there are. This leads to a sort of equilibrium, and a self fulfilling prophecy and would probably make an interesting case for game theory.

However, as a model for human behaviour, I find it incredibly interesting / ironic that there are a number of situations for which this type of model applies.

As I have previously written in a variety of posts, I feel as if any intrinsically unstable situation will eventually result in a recovery to it's equilibrium, however, it requires triggers and intervention in order to manifest. It requires a sort of perverse vigilance to the contrary.

Perverse in the sense that in order to maintain belief that equilibrium is inevitable simultaneiously requires a belief that the current situation is never in equilibrium. It's very paradoxical in the sense that the intended goal is assumed to be inevitable yet unreachable.

SWOT Analysis

Another way of looking at a SWOT analysis is a 2 x 2 matrix. Strengths and weaknesses are generally internal factors, Opportunities and Threats external. Strengths and Opportunities are positive aspects and Weaknesses and Threats are negative.

This is a great structure to apply to make team members more aware of the current context for decision making and setting direction.

This is a great structure to apply to make team members more aware of the current context for decision making and setting direction.Strengths

- What is our area of expertise?

- What is our inimitable difference?

- What are we recognized and associated with?

- What are the key factors in driving our brand equity?

- What can we improve?

- Where is the largest number of systematic failures?

- Who are our biggest critics and what are they focused on?

- Are there additional growth sectors in the market?

- Can our products and services be applied in other areas or have other uses?

- What are our processes dependent on?

- What risks are associated with our business?

- What is the probability of disruptions from external events?

- How can we leverage our Strengths?

- How can we improve each Weaknesses?

- How can we benefit from each Opportunity?

- How can we mitigate each Threat?

Other methodologies that pick up after a SWOT analysis include matching and converting.

Matching uses competitive advantage to pair strengths with opportunities.

[Case Study] Starbucks is very well known for it's coffee, but it didn't become a huge success overnight. Upon analyzing their business models, Howard Schultz understood that what they were selling was more than just coffee, but an experience. By leveraging the Starbucks expertise in coffee, he was able to extend the brand offering to "re-creating the Italian coffee-bar culture in the United States [as] Starbucks' differentiating factor".

Converting means converting weaknesses or threats to strengths or opportunities.

[Case Study] A threat McDonald's position in the wake of movies such as Super Size Me was a movement towards healthier living where McDonald's was decidedly not well positioned.

However, McDonald's is the world leader in standardized food preparation services, having pioneered the field in the 50's under Ray Kroc. With an opportunity in the growing healthy foods space, McDonald's leveraged it's strength and food processing skills to provide a new repertoire of products well outside their original hamburger mandate. Their product line retained their strength of delivering cheap convenient food (their hallmarks) while entering a new and growing market space.

Wednesday, April 22, 2009

Case Study: Manufacturing Capacity, Opening a New Factory

Salience: There are many factors which are important in making this decision. For instance, how much capacity is required after the proposed changes? What is the distribution network needs based on geography? What is the cost of the factors of production (land, labour, capital) associated with different locations?

Causality: With the goal of optimal operations to achieve maximum profitability, each of these factors will have a different effect on how you make your decision. In closing an old plant, you will have to do a cost / benefit analysis of each plant and determine which one makes the most sense to shut down. The following framework can be adapted to better understand the closing of one factory to the entire manufacturing load and network.

In the scenario of opening a new plant, you technically have more flexibility in terms of which locations where you want to open (including even outsourcing capacity from others) so we can start to build a framework about how to decide what consitutes an optimal solution.

Architecture: There are many factors to consider in a holistic approach.

- Geographic capacity demand.

- Distribution of products.

- Local labour, material and transportation costs.

- Resource availability.

- n is the number of current factories in operation

- R is the optimal vector of your new factory location

- Vi is the vector describing the locations of your relevant capacity factors.

- Qi is a weighting applied to the relative capacity impact of each location (a positive value implies a customer demand, a negative value implies a factory capacity supplied). This factor can also be scaled for other factors accordingly.

- i is a counter variable iterating from 1 to n (encompassing all elements affecting capacity)

Now, what if you only have a limited number of possibilities because of such factors as labour and resources are limited to big city areas etc? You need to match the profiles of your possible solutions to your "optimal" solution. However, in looking at your optimal solution, perhaps it will provide you with a potential solution that you had not previously considered (locating in a different town for instance).

Resolution: Although this is a very reasonable methodology, it only provides a mechanical answer based on the inputs provided and requires the analysts to accurately gauge the weight and importance of each individual factor. There may be many other influences such as political pressure to locate in a particular area. However, it acts as a logical framework for identifying the value of different locations while considering the broadest and more relevent factors relating to the capacity management decision.

[Case Study] A consulting company has 5 equally skilled consultants in the same field. 2 are in New York, one lives in Boston, MA and one in Philadelphia, PA. Their business is as follows is divided geographically as follows:

- 20% Philadelphia

- 50% New York

- 30% in Boston

Assume that each consultant is equally effective and the work is divided evenly. Also, the last consultant is more flexible to travel (but all consultants generally want to travel as little as possible), where should the last consultant reside?

Assume that each consultant is equally effective and the work is divided evenly. Also, the last consultant is more flexible to travel (but all consultants generally want to travel as little as possible), where should the last consultant reside?Using the formula above, what is the optimal location for the last consultant to reside?

[Answer: Hartford, Connecticut. Reasoning: Each consultant reflects 20% of the work load. This means that the consultant in Philadelphia can deal with the work load there. Two of the NY consultants reduce NY's capacity deficiency to 10% as does the consultant in Boston. Another way to look at the solution is that the only work left for this last consultant is equally split between New York and Boston.

The so in calculating the center of gravity, we learn that the optimal location solution is equidistant from New York and Boston (Hartford) - Note that Hartford was not a suggested location, but came up in the investigation.

Also note that the assumptions were just for simplicity in illustrating the solution, but the differences of the contributions, demands and travel costs of each individual component can be mathematically weighted against the whole - Philadelphia has more work demand than Boston, Senior Consultants do more work, costs for junior consultants is cheaper etc.]

Financial Planning - Boomer's Delaying Retirement?

The worse news is that many people only have a rough idea as to their retirement plan in general. This doesn't just include the money they are putting into their retirement savings, but also in terms of the consumption planning once they are in retirement.

There are a host of other financial investment opportunities available to retirees also (just because you have stopped working doesn't mean your money has to as well). There are Registered Retirement Income Funds which keep your money invested to produce moderate gains but also provide a liquidation schedule for you to access your money according to your plan.

Of course the best retirement planning (as reiterated repeatedly) is as early a possible (suggested early twenties). However, sooner is better than later as people can still make changes and plan for retirement as late as in their 50's. The suggested course of action is to see a financial planner to run through different scenarios to determine your financial flexibility and freedom.

Tuesday, April 21, 2009

Vulture Funds and Angel Investors... Similarities?

The first complaint about our market crash was that we should have seen it coming. PE ratios were high, LBOs were progressively looking less attractive (but still being done). All the signs were pointing to the market being generally overbought (too much money chasing too few investment opportunities). While most people agree that bubbles were forming, no one was willing to really do anything about it. Except, that is, the short sellers.

Short sellers are blamed with the precipitous decline of the market. By betting against the highly valued stocks, they are blamed with triggering the stop loss sales of equity associated with the rapid decline in price. Although I don't doubt short selling triggered the decline, I would also emphasize that they put themselves in a position of great risk. After all, no position in the stock market comes free, and a short position is decidedly not "group think" in the stock market, the giant positive reinforcement machine as described by Jim Chanos in Hedge Hunters. It is notable Chanos' short biased firm was among those asking the right questions which highlighted the accounting irregularities (and eventual fraud) at Enron. However, the real cause of the precipitous decline in equity prices is the automated stop loss sales.

Stop loss sales are limit orders placed on stocks by traders who essentially say this: "If the stock drops below a certain price, I want to sell of my position to prevent further losses". If I own 100 shares at $20, I want to sell it if it goes to $10 to recover $1,000, rather than lose all of it if it drops to $0. It is an automated stop gap measure to prevent total loss. However, look at the underlying logic: "I understand that there is a possibility that what I'm holding isn't worth even $10."

While incredibly oversimplified, this fundamental doubt acknowledges the distinct possibility that the stock is overvalued.

For those who said that the stock market was overvalued in 2007 / 2008 and that this crash is a "reckoning of careless and risky capitalist pursue of profits", the correction of such an oversight would be to bet against the market (ironically, also framed as a "risky capitalist pursuit of profits" but in the opposite direction).

I don't feel it is entirely fair for those who complain about the market being over valued to also complain about those who agree and are willing to put their money where their mouths are (by positioning themselves in a risky position against the consensus of everlasting growth).

Having said that, is it entirely fair that some companies crashed, reaching a point where they are utterly distressed? Again, in an efficient market, I would say yes and no. A company that has crashed beyond it's intrinsic value immediately becomes a target for a vulture fund. If it's equity is depressed because of overselling by emotionally panicked investors, I think this is a golden opportunity for vulture funds to step in and pick up cheap investments with the intent of saving the company.

The risk profiles of vulture funds and angel investors (venture capital) is surprisingly similar (except that I would assume vultures to be assuming more risk... The momentum is in the wrong direction). I would even go so far as to say that vulture funds are the last chance before the capitalism hell of bankruptcy (as Elizabeth Warren describes on the Daily Show: "Capitalism without bankruptcy is like Christianity without hell"). Metaphysically, I suppose a logical question to this analogy is are you selling your soul to the devil or seeking divine redemption as your escape?

This means that if a company is worth saving, even malicious intent by unscrupulous traders should be offset by intelligent analysts who can see value and pick up depressed stock prices (to the loss and chagrin of the "evil" short sellers). This is directly similar to my previous post about the mechanics of sales and trading. In an efficient market, even those who want to cheat should (and would likely) get burned.

In an ideal scenario, if companies became TOO distressed and all their financial vehicles (bonds, mezz, equity) became overly depressed, if the company could still be saved (good fundamental business model), this is a textbook example of how investors could come in, acquire a controlling share of the company and turn it around.

Yes, concessions and covenants have to be made, but without the assistance of vulture funds providing additional financing, the companies are about to go bankrupt anyways. The mechanics of short selling and vulture funds are simply investment and trading mechanisms, and like any technology can be used for "good" or "evil". However, I think it would be a error to generalize and mistake the white knight for the dragon.

Measuring Competitiveness - The Herfindahl-Hirschman Index

First, look at the different models available for describing a market place (in decreasing competitiveness): Perfectly competitive, monopolistic competition, oligopoly, and monopoly.

Looking at the extreme cases, we would expect a company in a perfectly competitive industry would have an insignificant market share (mathematically represented by an infinite number of firms with an infinitesimal market share). A monopoly would only have one firm will all the market share.

How can we use an index to describe the competitiveness of the intermediate competitive states? Number of firms is one option, however it needs to incorporate the relative market share for each.

Now let's return to the formula for HHI:

- Xi is the percent market share of firm i x 100

- n is the number of firms (or 50 if more than that)

Also, why choose a limit of 50 firms? Why place any limit at all? Well first of all, for every 50 firms, each additional firm contributes less than 2% (remember that firms are added from largest to smallest) and therefore affects the HHI less and less (less than 4 points out of a possible 10k). This was probably put in as a computational limit in order to simplify calculation. There is very little precision or accuracy lost by discounting remaining firms beyond 50.

An economically and mathematically perfectly competitive market will have an HHI of near 0 (in theory only, as a nearly perfect competitive market with 100 firms with 1% will still have a score of 100). A maximum HHI score (indicating a monopoly) occurs at 10,000.

The CFA text book proposes the following HHI metrics for the various competition levels:

- Perfect Competition less than 100

- Monopolistic Competition 101 to 999

- Oligopoly 1,000+

- Monopoly 10,000

- Competitive less than 1000

- Moderately competitive 1000 to 1800

- Uncompetitive 1800+

Monday, April 20, 2009

Supply Chain Management - The Vertical Integration Decision

Well as it turns out, there are very heavy capacity implications when making acquisition decisions up the chain. Each layer of the supply chain adds value (and challenges) in unique ways. What are the key metrics for creating a compelling case for vertical integration? If your organization:

- needs more control over your supply chain management (planning, synchronization, JIT inventory practices)

- requires a greater degree of customization not currently available through third parties

- has the capacity demand to generate your own economies of scale (lower costs)

- can experience growth and efficiency and capture synergies in the new vertical integration

Vertical integration can either be backwards (up the supply chain) to encompass inputs or forwards (down the supply chain) to encompass distribution channels.

What are the challenges to vertical integration? Each layer reflects a value added component and therefore is fraught with its unique challenges such as market sizing, competitiveness, industry regulations etc.

However, as a word of caution companies that do forward integrations (cutting out the "middle man") are often in danger of venturing into unknown territory as well as damaging relationships with other distributors (who can see this move by a company as repositioning from cooperative to competitive). This is exactly what happened between Harlequin and Simon & Schuster in the late 70's.

[Case Study] Today, Pepsi Co has put a set a $6 billion bid to acquire two of it's largest independent bottlers for Pepsi Bottling Group and Pepsi Americas. In this particular case, the decision for vertical acquisitions was driven by the need to gain a strategic advantage through controlling over 80% of their distribution. Each of the acquired companies shares are currently valued at 17% over their Friday closing price.

Price To Book - When EPS fails and you consider liquidation

Although there are generally two stages where negative EPS is characteristic (pre-mature growth and precipitous decline) I think the most appropriate use of this ratio is in liquidation (pre-decline). If negative EPS (or even negative operations income, NOI, manifested as negative operations cashflow versus positive invement and financing cash flow) is a result of growth, P/B will dramatically undervalue the ability of management and growth potential. A start up company will be dumping cash investments and financing in the hopes of future revenue.

I would propose that P/B is generally only useful as a ratio under very specific circumstances, particularly for use as a liquidation decision metric. For example, with a P/B of approximately 1, it would assume (that given perfect liquidity of remaining shareholder's equity) that for the cost for cutting up the company is approximately the same as it's acquiring price.

Therefore a P/B more than 1 means the company is overvalued compared to it's assets. This translates as either it is headed for decline (shorting opportunity) or investors think a turn around is possible with the difference reflecting "management value added" and potential growth of assets as is similar to any growing company.

This is the case that I would make to imply the P/B is a relatively useless decision metric for general investing, yet at the same time the only one that makes sense in the relatively narrow valuation space of liquidation.

International Marketing - Pitfalls of Translation

My favourite is the mistranslation of semi-formal as "demi-habillé" (or half dressed). As a result, the Quebecois, in a good natured attempt to remind English speaking Canadians of the importance of translation, collectively came to the semi-formal event literally half dressed in a shirt or blouse and boxer shorts (other more "creative" Quebecer's choose which half to dress up). Now at all semi-formal events, they come continue to come "demi-habillé". The proper translation for semi-formal is "tenue de ville".

While these mistranslations were embarrassing, we weren't alone in a few other disastrous mistranslations of advertising slogans by public entities.

With the recent 2008 Olympic games in China, I was fairly happy with some of the Mandarin translations of foreign products including:

- Coca Cola translated in Chinese to "Delicious Happiness".

- BMW is translated in Mandarin as Bao Ma (literally "valuable horse"). It also doesn't hurt that "Bao Ma" is a useful phonetic equivalent of the slang "Beamer".

This is also the case with certain lucky numbers and images in Chinese culture. For instance, the word for the number 4 sounds an awful lot like death and is therefore associated with bad luck. The number 8 is prosperity associated with fortune. The traditional Chinese new year greeting "Gong hei fat choi" contains the word "fat" sounding like 8. Without an intimate knowledge of the language and context, Babelfish style translations (replacing words with literal translations and with a rudimentary understanding of grammar) are sure to run awry.

Quantifying The Value of Trust - Assigning a Value to the Intangible

What had initially started off as a conversation about the mechanics of importing and financing (supply chains, letters of credit, customer relationships etc) eventually wandered into the realm of how to value trust.

It began with my colleague outlining the various incremental stages of an international supply chain relationship:

- New relationship. You don't know the supplier and the supplier doesn't know you. Although you both require each others services, you need to be sure that the other party won't default on their side of the transaction. You bring in banks (or government trade institutions) in order to secure financing and guarantees with an irrevocable letter of credit for the payables (supplier / exporter) and the appropriate shipping documentation for the receivables such as the bill of lading (importer).

- Mature relationship. You have conducted business with the supplier previously and are more familiar with the terms of delivery and credit. While perhaps there are not as many requirements necessary for insurance type guarantees against default, there is still the need for appropriate financial transactions. The banks are still involved in currency conversions and transactions.

- Intimate relationship. Payment and shipping terms can be adjusted according to needs of both parties with minimal (if any) intervention by intermediaries. This improves cash flow as well as just-in-time / economies of scale related inventory needs and has a built in stress tolerance against default.

For instance, between stages 1 and 2, the monetary value of the improved relationship and trust can be approximated by the reduction of cost associated with no longer requiring intermediaries such as banks to provide services to insure and guarantee the transaction. This can become quite sizable as the fees associated with these services are not insignificant. You are essentially paying banks to manage risk for you.

Between stages 2 and 3, the monetary value is a bit less obvious, but still applicable. For instance, financing costs with deferring payment can be calculated as the marginal cost of capital required to reorganize the payment schedule. The cost of financing to improve cash flow is also not marginal relative to the overall costs of the transaction (usually a sizable percentage).

In this way, it is easier to put a price tag on something intangible by looking at the opportunity cost of the alternatives and the financial outlays associated with each. It also quantifies the investment in your relationship with suppliers (or customers) to see what the hidden costs were to arrive at these more optimal arrangements.

Sunday, April 19, 2009

Simulated Reverse Dilution

While I suggest one possible alternative and it's reasoning, I think it becomes quite obvious why this doesn't happen (at least not directly).

First of all, a dilution conversion is taken in the circumstance when a company seems to be about to reach a tipping point of success as those holding the convertible options of preferred shares decide to convert to common shares. Until these conversion options expire, holders of the preferred shares would probably prefer to take their dividends (cash in pocket) until the last minute, maximizing the value of their options and reducing the risk of the company crashing in the interim. When the decision for the dilution decision is reached (depending on a variety of criteria) it is essentially based on the maturity and stability of the company.

This means that to take the reverse action is to bet against the maturity of the company. In the reverse analysis of the decision criteria, it assumes that EPS is weaker than dividends. In the scenario of an established company, this comes as a major red flag that the company is in distress if it is struggling to generate the necessary revenue to sustain it's cash payment obligations.

To simulate the reverse of a conversion, this would essentially mean shorting the common equity position and picking up preferred shares. However, assuming all preferred shares are converted and unless more preferred shares are issued, this is incredibly difficult (because there is nothing to buy to simulate the reverse conversion). Usually, the only comparable option is to pick up debt (short equity and go long on the companies bonds - a similar concept to the flight of quality).

However, if you are looking and manuevering solely in one company (rather than the entire market) and your only move is to reallocate your assets from equity to debt holdings, you are essentially burning down the house to get the insurance money. The corellation between these two assets (despite being in different asset classes) is extremely high. After all, a company experiencing distress won't only feel it in it's equity prices but probably also in it's solvency ratios (possibly reflecting a downgrade in it's credit rating).

As is unfortunately common practice in todays market, companies in distress are experiencing financial difficulties in both its debt ratings and equity value meaning that it will struggle to raise additional financing.

Vulture funds who see this coming will dump financial support of companies (perhaps even shorting them) in the hopes of picking up distressed funds for pennies on the dollar and looking for upside on the turn around and restructuring of the company. Obviously, this is incredibly risky as even distressed assets are cheap for a reason. Financial gravity is such that recoveries in such scenarios are often unlikely.

Although similar to deleveraging in many respects, focusing on distressed companies is different in that in the toughest times, everyone gets a "hair cut". Except for bankrupcy liquidation (Chapter 7) where senior debt has priority claim (and which is rarely used seeing as companies generally hate admitting defeat), restructuring (Chapter 11) is such that everyone who owns a stake, bond holders, mezzanine financing and even equity holders make concessions. Usually, this comes in the form of bond holders and mezz financing to take reduced claims while equity holders and other stakeholders (employees) make covenents (reduced wages, selling off non-performing divisions etc).

Jack and Suzy Welch, Winning

to describe the mechanics of success

so that anyone can understand."

Jack is an avid crusader against unnecessary bureaucracy and management layers in favour of flexibility and ownership as a mechanism for empowerment. The ideas he puts forth in his books expounds his philosophy that direct communication and quick action in its various forms are the key to success in a variety of different operational functions.

While hardly a new book, it is one of my favourites. Jack deals with a broad range of topics, each of which is still relevant (sadly) today. Some of my favourite topics discussed are:

- Candor - direct and clear communication of unpleasant (but necessary) topics in the search for solutions

- Differentiation - the acknowledgment and rewarding of good work and values and the correction of poor behaviours (a natural corollary to candor)

- The hiring batting average - holding recruiters responsible for building an organizational culture around performance

- Divesture and parting ways - dealing with issues of strategic and systematic non-performance in organizations and individuals

- Six-sigma - Understanding the value of consistency. Literally in statistics: reducing the variance of output to encompass six sigmas (standard deviations) - a *very* narrow band in any field

- Ownership in career management - taking responsibility for advancement through adding value and understanding your role

Sent from my BlackBerry device on the Rogers Wireless Network

Thursday, April 16, 2009

Using Oligopolies and Monopolies to Model Union Behaviour

While it should hardly be a surprise that organizations and individuals look out for their own best interests, why is it permissible for some to exhibit behaviours that would be considered illegal by others?

What do I mean? Unions are essentially collaborating (colluding) with each other in order to capture as much of the labour market as possible across different industries. Whatever sectors they have influence over will usually experience inflated costs. If any business ever did that, they would be struck with anti-trust and anti-competition legislation.

Now any intelligent person will immediately point out that people should not be treated in the same way as oil. Of course not. However, the fruits of their labour can be quantified as a wage and to stray too far from that natural intrinsic value is poor practice.

Don't get me wrong. I don't think labour should be under paid. That scenario is just as unstable (and disastrous). But please don't act surprised or insulted when there is an inevitable reckoning when a scenario demanding more competitive practices force dramatic changes. Inefficient and unfair practices, whatever form they take, are inherently unstable. This is currently the scenario with Fiat purchasing Chrysler but incredibly weary of union wages inflated above the industry norm.

The difference between a union and good management is that good management should adjust wages as close as possible to their intrinsic value (up or down). Bad management will always try to under cut and unions will always try to get more. Its ironic (and extremely unfortunate) that in unions often start (and perpetually persist) in companies that at one time or another exhibit bad management practices regarding labour. Resulting in extravagant tug-of-wars in which no one really wins.

The best way to keep a union out? Be a responsive, flat and flexible management. Pay your staff well, respect them and be sensitive to their needs so they don't feel like they need an "additional management layer / political structure" to take membership dues in order to insulate them from poor management. A scenario where you regularly pay dues requires you to regularly justify your use of those fees (as any accountable organization should) and the situation naturally becomes resistant to change as unions are required by their mandates to always fight for higher wages even if the situation does not permit it (this is due to the zero-sum non-efficient use of membership fees to capture labour "demand surpluses" of businesses).

Regarding my previous model of profit per employee, I think that there should also be a risk / reward model when applied to wages for jobs. This is in direct response to critics who see CEO's with large compensation packages who leave sinking ships. I firmly believe (as do our capital markets) that if you want higher rewards, you must take more risks. The golden parachutes provided to CEO's seem to defy this logic. Certainly another example of an unstable scenario that doesn't "feel right".

Mechanics of Sales and Trading

I just returned from an interactive demo of the Finance Lab at the Rotman School of Management at the University of Toronto. In a class room with about 40 people, we were all engaged in trading two stocks on a fictitious market. It was everyone's first time on the software as we started the market simulation. It was my first time using this type of software and it was absolutely exhilarating!

[Recap] For those of you not familiar with how a stock market works, for any given stock, there is a list of bids and asks. Bids are prices which people are willing to pay to buy the stock, asks are prices people are willing to sell the stock. The highest bid and the lowest ask is the current spread. As transactions occur on either side at "market value", the highest bids and lowest asks are picked off. The only way these lists increase is when people put in "limit" orders (orders that explicitly say "buy or sell at this price only"). If there is too much buying, the stock price goes up dramatically. Conversely for selling.

Round 1: Unreasonable Profits As my partner and I started the simulation, it was clear most of the people in the room didn't really know what was going on. Their buy and sell strategies were essentially random. However, as I watched the monitors, I could quickly see that one of the stocks ("TAME") was quickly running out of asks (the number of requested transactions was low) and I spotted an opportunity to make an unreasonable (and highly illegal) profit. People wanted to participate in the market, weren't familiar with short selling, so the only actions they knew to do was to "buy". This stock was quickly becoming overbought.

Assuming that *someone* wasn't paying attention, I could put in an outrageous ask price (the stock was selling at ~$25) at around $500 and deliberately clear out all the remaining ask orders. That meant that if I was fast enough I could control the market price and the next time someone foolishly bought TAME at market price, I would sell my stock for at 20x (2000%). So we did it. And it worked. Some poor trader (or possibly a few poor traders) got killed, buying a $25 stock at $500. We were arbitraging carelessness. We quickly created and popped a bubble.

We had enough money to buy out the competition and manipulate the stock price (both highly unethical as well as highly illegal). We closed out with a return of 26% when the average was about 1%. An astronomically good return for a year of investing, let alone 5 minutes of trading.

Round 2: Good Profits After getting some more instruction, everyone in the room was given instructions to trade using only limit orders. This made it impossible to perform the same "trick" so we participated and looked for tighter spreads with more volume.

We closed out with a return of about 12% which was still in the top two thirds.

Round 3: Average By the time we got to the last round, the rest of the class had caught up and it was difficult for anyone to gain an informational (or strategic) advantage over anyone else. Our market was incredibly crowded (trading only two securities) and the only way to maximize profit was to do spread trading and rely on the computer player (designed to simulate relatively random decisions) to make mistakes and capitalize on them as well as take commissions from simulated "institutional" buyers. But in this case, no one had any advantage over anyone else.

The final scores were a relatively tight distribution with us still slightly above average (essentially random results - with everyone making gains due to the "rising tide" - computer simulated money entering the market).

Lesson: I think a lesson here is that efficient and competitive markets are the best markets. While that may be an obvious observation for most academics and intuitively clever people, it was certainly another matter all together to experience theory in practice in a live simulation. As it turns out:

- The more aware you are of your surroundings, the less likely you are to make careless mistakes (like buying a $25 dollar stock at a "market" price of $500)

- Our (illegal and unethical) strategy should have back fired if people were paying attention (as they did in rounds 2 and 3) by stepping in when the price got too high and keeping it deflated (someone could have "under cut" our outrageous ask price, but posting their own ask price at a more reasonable (but still highly profitable) $30 (and this process can and should occur iteratively until the stock reaches its intrinsic value on both sides of the bid / ask spread).

- The more competitive a market is, the harder it is to make abnormal profits regardless of strategies used.

- People in sales and trading can't trade by "committee" or even pairs, although my partner and I got along really well, those split seconds where we seeked each other's approval for executing trades killed us a lot. I think that each person needs to live and die by their own sword in sales and trading because the trading windows of opportunity you are operating in are so narrow. This is in stark contrast to what should happen in a fund, where associates need to work with portfolio managers in valuations and analysis.

- Scalpers make money off the the bid / ask spread and tend to do better with stable prices. People who have specific positions will do better with more volatility if they can anticipate the movement of the price.

Sins of the Son visited upon Father - Trading on a Good Name

What happens if you can't pay? The bank will chase you as well as your guarantor. As we'll soon see through this post, there are many forms of improving credit ratings (for individuals as well as corporations) which have had mixed results.

This type of challenge presents an interesting "middleman" opportunity for funds (or organizations with good credit ratings and cash flow) to trade on their good name for a profit by enhancing credit ratings (what AIG did with its credit default swaps on CDO's of sub prime mortgages to insure the senior tranche receivables).

Without a middleman, a corporation with a lower rating (BBB) also has the option to create a credit enhanced "special purpose entity / vehicle", a non-operating entity created to carry out a specified purpose, in this case to finance or securitizing receivables. In other words, you separate the receivables from the debt rating of the issuing company.

A question I would then ask is what is the rating based on? I would have to assume that it would be more reflective of the rating of the company from whom the receivables are owed against (with some additional margin premiums for business transaction risks etc).

Sound familiar yet dangerous? This is a very similar structure to what Andy Fastow did with Enron's assets (like investment bank purchasing "receivables", overinflated marked-to-market accounts which would never be collected) through LJM and other limited partnership special purpose entities. However, rather than treat this as debt, he inappropriately hid this as earnings through LJM. Arthur Anderson fell apart by overlooking practices such as this which are incredibly deceptive.

There exists an opportunity for investors to do this on their own as well by trading bonds of other companies. For instance:

Look at a company A who has a AAA rating bond instrument and company B who has a AAA rating bond. Assume the companies have fundamentally similar characteristics (they should be priced the same).

Assume (due to market inefficiency) that there is a scenario where demand for company A's bond is very high, and B's is low. An investor who spots this inefficiency can short bond A and go long bond B.

Or for management in company A, they can issuing more A bonds and buy B bonds. This is equivalent to using their good name to raise funds for a third party. From a market net neutral perspective, you are profiting in the difference in credit ratings (or a lack of cash flow or other yield metric).

Whatever the cause of the premium on the cost of debt, by taking this long / short position you are bearing the risk / reward associated with this spread.

The most common example of this type of "credit swapping"? Sale of receivables or collateralized borrowing.

The catch? If B's bonds get downgraded (or defaults etc) A is left holding the bag. In the same way that the sins of the son would be visited upon the father, so too should companies trading credit be aware.

However, this is a dangerous game to play. Most (if not all) frauds and financial collapses have involved the improper use and accounting of debt.

Wednesday, April 15, 2009

Fiat and Chrysler - Huge Changes Needed

Whatever your opinion on management, unions and products Chrysler isn't working. And it will take a lot more than just some marginal improvements to bring it back. Union's make a good target because they have exceptionally high labour rates. It doesn't hurt the flow of criticism that the CAW demands seems to be out of touch with the current economic environment.

While supply side economists have often been criticized for being too laissez-faire when it comes to professing the need to let economy's crash and the strong survive (while many who own stock in weak companies are now reconsidering their positions - it's only painful when it happens to you), other economists have to acknowledge the real dangers of artificially inflated costs such as wages in the long run. In retrospect, this shouldn't really have come as a surprise.

And people will always point to other car companies doing well, such as Honda and Toyota saying that it is not impossible to succeed in the current environment. So why should hand outs be given to those who are failing?

I do sympathize with workers and pensioners who have lost a lot of the value of their pensions, however, I wonder how much of their pension plan was composed of Chrysler stock, or even how much of Chrysler stock made up any form of compensation package. How much were workers made to take ownership for the success of the company rather than simply try to negotiate a higher wage.

Rather than always have adversarial positions, was it not possible to compensate workers with ownership? This constantly seems to be a recurring theme in union relationships and the topic of entitlement. They are literally now in a position where they can all lose their jobs if they don't take a major pay cut.

I wouldn't call Marchionne predatory, I'd say he's looking not to get screwed. Unions pride themselves on being a democratic system. Marchionne is merely participating in a financially democratic way (as do other investors and customers of Chrysler), voting with his companies money on which what would be a good investment. Stakeholders of Chrysler are hoping that he doesn't end up voting with his feet.

There is a difference between bailing out AIG, an insurance company who is supposed to instill confidence in the system, versus a car company which was already on its way out. Same with dying newspapers.

The April 30th deadline is fast approaching and it looks increasingly as if this may be the end of the line for Chrysler.

Story of Stuff - Sustainability and Statistics

I was recently introduced to this interesting video on the history of stuff (~21 min) and thought it might be helpful to do a quick review. I think there are some brilliant messages here, but at the same time, I think this is a prime example of having to look more closely at statistics and question what's presented. First let's look at some of the key points:

- Linear systems are not sustainable (and certainly cannot support exponential growth). You need a cyclic system in order even have a chance.

- Externalizing costs is a model which offsets the factors of production to keep costs low (and like over utilizing any resource is itself unsustainable).

- The three R's are Reduce, Reuse, Recycle (in that order). Recycling should actually be a last resort from a sustainable consumption perspective.

For instance, Anne Leonard states that 99% of everything we consume is disposed of in 6 months. That's a lot. I have a general heuristic for these types of scenarios. If your statistic produces a result of more than 90%, that generally means there is some selective data mining going on. To reach a number like 99%, it suddenly becomes more interesting as to define what is the 1% that we keep beyond 6 months. It seems pretty astronomical, yet something about this doesn't seem right. What could possibly justify this number?

- Why six months? Why not look at a quarter? A year?

- Is it measured by income dollars spent? Mass of goods? Volume occupied in a landfill versus in storage?

- What's included? Housing, food, gasoline, seasonal clothes, books, text books per semester, garbage?

- What would be a more appropriate number given the same metrics? What should we aim for?

I am very opposed to peak to trough comparisons in behavioural studies because they represent extremes. I'd be more impressed with a normalized study over time with standard deviations rather than an opportunistic snapshot of a scenario 50 years earlier. This is because I'd expect that despite the growth of consumption, there is a corresponding diminishing utility that Anne hints at as a cause of decreased happiness since the 50s.

Her point on computers and planned obsolescence is both correct in many respects yet highly oversimplified and as a result (I would suggest) misleading. She implies that a computer upgrade is simply a CPU replacement and that companies intentionally design chips so that they cannot be easily substituted.

Upgrading a computer can *sometimes* be as simple as replacing a chip, but often with increases processing power come increases in bus speed and memory. A computer system is a much more complicated than simply replacing an old chip with a newer, better one. It's not just a matter of "shape" as suggested. Actually, the change in shape is deliberate to prevent people who don't understand how computers work from blindly substituting in parts (and destroying both).

Despite my negative tone regarding her use of statistics, I really think Anne has done something phenomenal. Her attempts to reach a broad audience are successful, but she does sacrifice a bit of credibility for accessibility. Some of her broad and extreme claims leave her work more vulnerable to criticism than it should be. I do like her proposed solutions, but I think the corresponding required change in consumer behaviour will be quite a challenge. I think that everyone should spend the just 21 minutes and watch this video.

Tuesday, April 14, 2009

Create Your Own Dividend Policy

For instance, if you liked a regular and steady coupon payment, but had no interest in the other components of a bond, you can go long on a bond with a coupon but short a zero-coupon bond to achieve a coupon strip similar to preferred shares (relatively hedged and insulated from changes in the debt market and interest rates, but yet not quite like equity - more senior).

Although I generally love the idea of creating strategies to manage risk and opportunity (deleveraging, swaps etc) one of my favourites (also simple to explain) is dividends versus EPS. The formula for their relationship is:

Note: EPS x retention ratio is often a proxy for equity growth rate - How much money stays with in the company's balance sheet as retained earnings (change or growth in equity).

Now regardless of whether or not a company board decides to approve and issue a dividend based on its operations and cash position, you can create your own "dividend policy".

In the case where a company issues a dividend, but you think they will experience more rapid growth, you can be short the dividend and long the stock (an identical concept to dividend reinvestment). Take the money you receive as a dividend and buy more stock (equity).

In the reverse, where a company doesn't issue a dividend, but you feel like they should, you can be short the stock and long the dividend (begin to liquidate your position for cash). The net effects of each strategy allows you the flexibility to determine and invoke your own virtual dividend policy.

Note that as valuation models, these are all concepts very interrelated to the cost of capital, PE ratios, and dilution as they will effect your fundamental perspective on whether or not you feel dividends should be issued in the first place. This is a fancy way of saying do you think the stock is currently overvalued against it's earnings when you consider it's growth ratio.

Selfish Sustainability - Save or Starve pt 3

While our hotel was able to improve the situation for the local populace, as I mentioned towards the end of part 2, this acts only as a starting point for those who are concerned about the broadest picture:

Migration Patterns and Shared Responsibility

One of the challenges we face is that although individual countries try to protect what's in their waters, the migration and mating patterns of aquatic life are such that they often move from place to place. While 80% of every aquatic species in the world can be found in the "golden triangle" between Malaysia, the Philippines and Indonesia, each location has different laws and different populaces. While you can protect species in one area, it does you no good if they are being over fished or otherwise destroyed in another. Therefore there is still some unmitigated risk exposure and protection must become a shared responsibility.

This is analogous to many other environmental cases (such as CO2 emissions) as these issues can propagate across geographies and therefore become shared responsibilities.

Market Failure - Dealing with the Black Market Space

The problem with protecting an endangered species is that because it is so rare, it also becomes valuable (think of an inelastic and weak 'supply' curve otherwise known as the species' population - supply push 'inflation'). As a prized fish suddenly becomes more rare, the market price for capturing and consuming one goes up. The incentive to find and catch one goes up as well. The only 'counter balance' is that they become harder to find, but that is hardly any real reconciliation.

When asked what was your definition of endangered, a colleague of mine remarked: "Anything that humans take out of the sea that they don't put back." This idea of a linear relationship with our natural resources won't hold because our population and consumption is growing exponentially. Linear relationships cannot support exponential ones without some form of crash as the inevitable conclusion.

Destroying - Much easier than creating

Destroying (or depleting) a natural resource is *much* easier than creating or renewing one. And there are *many* more people destroying than creating. It takes only moments of carelessness to destroy a coral bed, but years to have it grow back (even with modern technology).

Accelerating the systematic entropy and decay is a disaster. Externalizing the costs is a neat way to offset your responsibility, but it is an unstable model who's destiny is to collapse (with dire consequences).

Sustainability and competition for resources is one of those types of problems that will inevitably come up on the radar if it hasn't already. Basic science and economics dictate that it is coming and we need to pay attention to these issues.

Monday, April 13, 2009

Kickstart - How Successful Canadians Got Started

Canadian talent usually tends to be understated, and these authors venture out to learn from successful Canadians and how they got their start in life. Many of us can sympathize with (or are currently experiencing) the concept of a quarter-life crisis, the idea that we have reached a point in our lives where we are re-evaluating how we want to apply ourselves and the directions we want to set.

Each personality has a different definition and vision for how they apply themselves and what they want to achieve. There are a broad range of experiences, each with its own lessons for any reader. Interestingly, one's "key to success" could become another's potential road to disaster.

I think the book's structure makes it both interesting and easily digestible. It certainly feels as if each story is like sitting down for a coffee with the interviewee. The biographies are divided into three groups: Searchers, Survivors and Dreamers, and each story reflects the Canadian perspective and highlights how our unique backgrounds can help (or impede) our path to success (whatever form it takes).

A must read for young Canadians, especially those of us about to (or who have recently) come out of university and are dealing with the quarter-life crisis. The three authors are friends of mine from high school and (as the introduction suggests) are currently facing the same challenges that we all are.

Sent from my BlackBerry device on the Rogers Wireless Network

Saturday, April 11, 2009

CAPM to PE - Theories to Prices

E(R) is the expected rate of return (which relates to the cost of equity)

RFR is the rate of return for a 'risk free asset' (approximated with treasury bill rate)

Rm is the return for the market portfolio (or in this case, security)

beta is the standarized measure of systematic risk.

Another way of thinking of the formula is what compensation is needed for me to take on additional risk (risk premium is the Rm - RFR term). It has a very similar relationship with the Sharpe ratio in analyzing marginal utility of volatility in an overall portfolio.

If you can calculate the beta (based on volatility) to determine the expected rate of return (in an efficient market portfolio), they you can create a good valuation model for determining your expected rate of return.

As I had mentioned in my previous post, you can then extend the previous model for using WACC and PE to determine a price for your equity, essentially adding more pieces to your puzzle to get a clearer picture. This can be applied in the real world as a framework to analyze along the valuation chain to see if any key assumptions look incorrect (and avoid or capitalize on mispricings).

Selfish Sustainability - Save or Starve pt 2

Now that we had a "new" mission, e were forced to help change. Not by governments nor regulations, but our own self interest as a profit loving entity. We had to take a new perspective on our goals and extended the scope. Now we were a force of change.

New Problem: Depletion of natural resources

We can't call ourselves a top luxury hotel with pristine nature if the sea bed has been bombed to smithereens. Our natural resources are being depleted in a decidedly unnatural rate. As mentioned in my previous post, we had to understand why.

Salience:

We need to increase the awareness of the damage that's being done to our natural resources with the public. Issues arise that quickly become apparent. This is an illegal activity. You can't just advertise a class for fish bombers and hope you get good attendance.

We also need to address the poverty and danger associated with this negative short term thinking and the negative economic externalities they impose on the local community.

Causality:

Fish bombing is driven by a combination of poverty which is a result of a lack of opportunity, education and awareness in the general local public. It also thrives because of lack of policing due to difficulty to coordinate naval operations with the community.

Architecture:

How should we model our action plan to solve these challenges?

- There is a need to work closely and communicate with the community to educate them and start a community dialogue. We need to educate our society to understand the value of this natural resource for everyone.

- We need to fight the root causes of this destruction and poverty by creating better, higher paying jobs and opportunities for local members of the community. Suddenly, instead of selling a pile of dead fish for a few RM each, you can have wealthy tourists pay you the same amount just to look at them. One of these you can do forever. The other guarantees your children a worse future than what you have now.

- The community needs to be connected to the relevant policing agencies to actively protect our natural resources.

A higher quality resort demanded higher quality service. We had to introduce language classes, service training to give our staff an opportunity to develop into new more fulfilling roles. It was nice to see local hires who saw the resort as a family. No longer simply "changing sheets", they became part of the hotel experience and fellow nature lovers.

Our staff numbers more than doubled from the previous management (which excludes the second island resort), wages and benefits also increased (caused by the increased demand for labour). In one of the arguably best applications of supply side economic theory working in the real world, we demanded more from our team, compensated them better to keep them and they stepped up to the task.

Also, we developed incredible programs such as the Marine Ecology Research Center (MERC) based on leading edge research to restore marine life in the water. We increased the number of PADI certified divers in our resort, making diving equipment and training accessible to our locally based general employees so that they could experience and understand what they were protecting.

We started our own sustainable fish farms and water treatment and recycling systems. As an island resort, we couldn't just hook up to the city mains. Plus our treatment systems were more advanced that those provided by the city. We made an effort to have our values and behaviours reflect our over arching philosophy. We are profiting from nature, so we have to protect our interests.

Long Term Outlook and Lessons Learned:

If you want to use capitalism as a force for good, how can you redirect 'greed and the drive for profits' into a solution for sustainability? Align the corporation with the values of society. Our situation was unique. There was a direct correlation between the health of our environment and our profits. Our environment: Save or starve.

Anyone who is a cynic of corporations will immediately raise their hand and ask "Uh... Shouldn't governments be looking after the natural resources and interests?" Absolutely. But some governments are not as wealthy as others. The unfortunate truth is that many wealthy countries have exploited their natural resources. The remaining ones that are naturally beautiful usually remain that way because they haven't been industrialized (and tend to be poorer). While this isn't strictly always the case, often governments often can't afford to police and protect their resources. Malaysia is hardly unique in this area. They know they have a valuable resource and are working hard to try to find more effective ways of protecting it.

This was a topic of the Asia Pacific Ecotourism Conference (APECO). While corporations may not be the best solution in all cases, it certainly beats the solution of no awareness and no responsibility. There were countless examples of beautiful areas that were ruined because they were neglected. These areas were notorious for exploitation by seemingly less scrupulous individuals who (it turns out) were just looking to feed their families.

There are certainly a lot more issues and complexity that arise from the discussions and further study regarding ecotourism policies, corporate social responsibility and sustainability. This series of posts is intended only as a starting point to illuminate another path for more enlightened discussion:

- Corporations, if used appropriately, can actually be a force for good rather than stereotypical greed,

- Corporations can contribute funds to develop positive programs, real opportunities and supply good jobs, rather than simply act as a source of tax shelter based charitable donations, and that

- Integrative thinking can help you find the surprising nugget of gold in a case where there is a lot of chaotic data and relationships